Navigating Chapter 7 can be challenging, especially with debts from unemployment insurance overpayments. I recently helped my client Ron through this situation.

Ron called me with his problem: “Chris, I need your help. I’ve been overpaid on my unemployment insurance, and now I owe a significant amount. Can this debt be discharged if I file for Chapter 7 bankruptcy?”

“That’s a good question, Ron,” I replied. “If you’ve been honest with the unemployment office, Chapter 7 should allow you to discharge the overpayments.”

“Yes, I’ve been honest, Chris. I promise,” he assured me.

“Then you should be okay if you file for bankruptcy. I didn’t realize how tough things had become for you after losing your job. I wish you’d reached out sooner for advice on managing your debts.”

“I probably should have. It’s hard to confront these problems,” he admitted. “I’ve thought about bankruptcy for a while but knew little about its benefits. This new debt pushed me to call you.”

“I’m glad you did. I’ll explain what filing for Chapter 7 involves and how unemployment overpayments fit in,” I said. “We’ll then assess if it’s the right choice—not just for this new debt but to improve your overall financial situation.”

“Thanks, Chris. I’m ready when you are,” he said.

Dealing with financial struggles in Texas, with its complex legal landscape, can be overwhelming. If you’re facing both debt and unemployment overpayments like Ron, Chapter 7 might feel like a maze. Understanding your rights and how these issues interact under Texas law is crucial. My goal is to provide the knowledge you need to navigate Chapter 7 bankruptcy and address unemployment overpayments effectively.

Chapter 7 Bankruptcy: A Fresh Start in Texas

The purpose of a Chapter 7 bankruptcy proceeding in Texas is to give honest debtors a financial fresh start. This process allows for the liquidation of non-exempt assets to pay off creditors. With Chapter 7 bankruptcy, any remaining debts are typically discharged, meaning you’re no longer legally obligated to repay those debts.

When Unemployment Benefits Become Debt: Understanding Overpayments

Unemployment benefits act as a safety net during job loss. But what happens when you receive more benefits than you’re entitled to? This is where the concept of unemployment overpayments comes into play.

Unemployment overpayments occur for various reasons. These reasons can include errors in reporting your income or changes in your eligibility. Regardless of the reason, owing money for an overpayment transforms this helpful safety net into another debt burden. In Texas, this adds another layer of complexity when seeking bankruptcy protection.

How Chapter 7 Bankruptcy Affects Unemployment Overpayments

Now that you have a basic understanding of Chapter 7 bankruptcy and unemployment overpayment, let’s explore how they intersect. In a Texas bankruptcy case, whether an unemployment overpayment can be discharged depends on its nature – specifically, was the overpayment fraudulent or non-fraudulent? This distinction significantly affects your bankruptcy case.

Non-Fraudulent Overpayments in Chapter 7

Non-fraudulent unemployment overpayments are unintentional. Administrative errors or misunderstandings of eligibility requirements typically cause these overpayments. Thankfully, under the federal Bankruptcy Code, the courts consider non-fraudulent overpayments as dischargeable debts.

This means the court treats them like most other unsecured debts during a Chapter 7 bankruptcy proceeding. As a result, you likely won’t have to repay those debts after completing your bankruptcy case.

Fraudulent Overpayments: A Different Story

Fraudulent unemployment overpayments involve a deliberate attempt to deceive the system. This could mean providing false information about your employment status or earnings to receive higher benefits.

Texas courts adopt a much tougher stance in cases involving fraud and generally consider fraudulent debts non-dischargeable. This distinction highlights the importance of accuracy and honesty when applying for and receiving unemployment benefits.

Navigating Chapter 7 Bankruptcy with Unemployment Overpayment in Texas

Successfully navigating the intersection of Chapter 7 bankruptcy and unemployment overpayments requires understanding your specific circumstances and seeking experienced legal guidance. It’s crucial to contact a qualified bankruptcy attorney in Texas to discuss your situation.

FAQs about Chapter 7 Bankruptcy and Unemployment Overpayments in Texas

Can Chapter 7 address unemployment overpayments?

What is Chapter 7 bankruptcy often referred to, and why?

People often call Chapter 7 bankruptcy a “liquidation bankruptcy.” It earns this name because in some Chapter 7 cases, a court-appointed trustee collects a debtor’s non-exempt assets. The trustee then sells the assets and turns them into money. They use the money from the proceeds to pay back creditors. Essentially, the assets are liquidated to pay off debts.

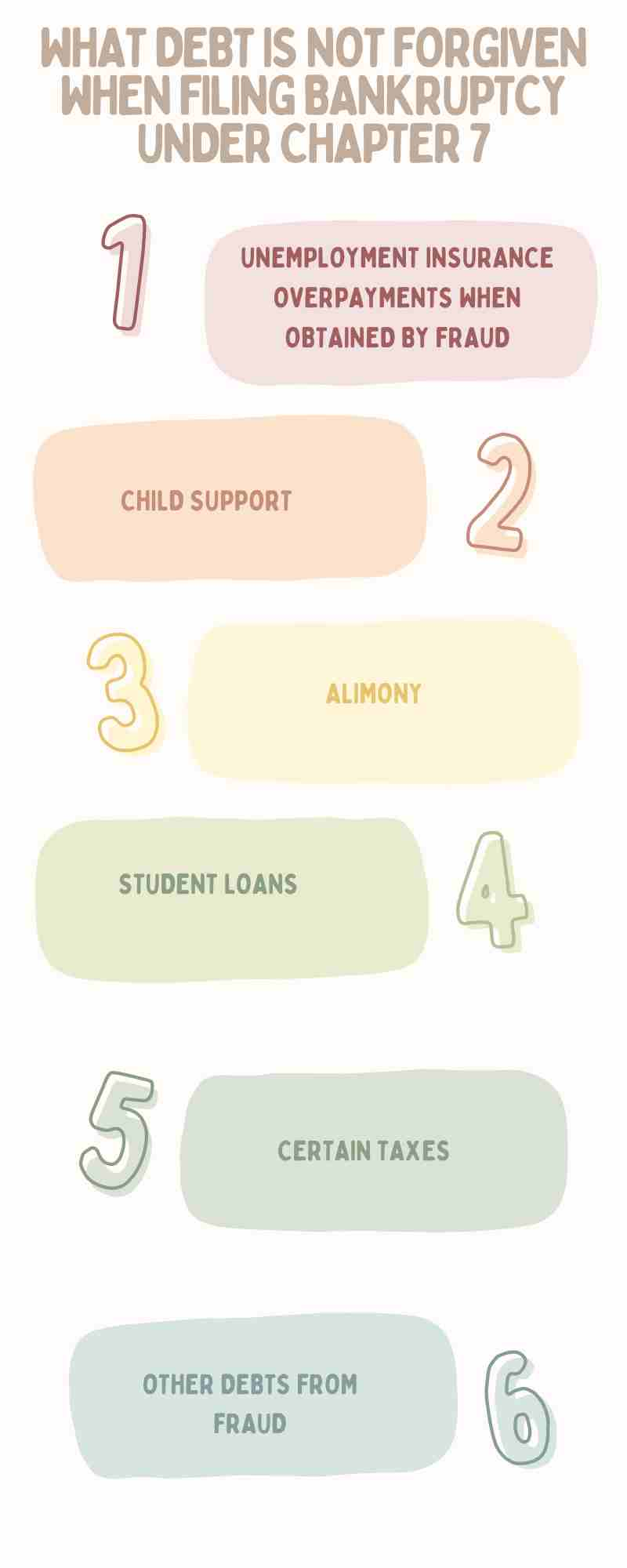

What is forgiven when filing bankruptcy under Chapter 7?

Chapter 7 bankruptcy can eliminate (discharge) various unsecured debts, including credit card debt, medical bills, and personal loans. However, some debts are typically not dischargeable in Chapter 7:

- Unemployment insurance payments and/or unemployment compensation when obtained by Fraud

- Child Support

- Alimony

- Student Loans (unless very specific conditions are met)

- Certain Taxes

- Other Debts from Fraud

Understanding which debts are dischargeable and non-dischargeable is crucial when considering filing for Chapter 7.

Can I keep my car if I file Chapter 7 in Texas?

Texas has generous homestead exemption laws that allow you to protect specific assets, like your home, car, and personal belongings, from creditors. A bankruptcy attorney will determine if you can keep your car by considering factors such as the car’s value, the outstanding loan balance, and how much equity in the vehicle is protected by exemptions under Texas law.

How much cash is exempt in Chapter 7 in Texas?

Texas doesn’t have a specific exemption amount for cash. However, you can use federal “wildcard” exemptions. These exemptions allow you to protect a certain dollar amount of personal property of your choosing. This exemption might be applicable to cash, but it’s essential to consult with an attorney to understand how these exemptions apply to your specific situation.

Conclusion

The pressure of debt, unemployment, and insurance overpayments can feel incredibly overwhelming. Keep in mind that bankruptcy laws exist to give honest individuals and families a chance to regain their financial footing.

Filing for Chapter 7, even with the complexity of unemployment overpayment issues, can provide much-needed debt relief. Being proactive, informed, and seeking professional help will ensure you’re taking the right steps towards a brighter financial future.

Will Ron File For Chapter 7?

As soon as I gave Ron this overview, he assured me he had always been upfront and honest in his unemployment insurance applications. I could tell he had listened closely.

“So if I was honest, and it wasn’t my fault, then the overpayment debt should get discharged, right?” Ron asked.

“Yes, if it’s that straightforward. I’d like to know where the error occurred, how, and when you discovered it,” I told him.

“In all honesty, I noticed the payments were a bit higher than expected but never thought it was an overpayment. It didn’t seem like much each time, but it adds up,” he said.

“Thanks for being honest, Ron,” I said. “We need detailed information about the error to decide if we can pursue a discharge. Remember, this overpayment is just one part of your Chapter 7 filing. I’ll also review all your debts, assets, income, and expenses. Please provide a complete and truthful picture of your financial situation so we can determine if Chapter 7 is right for you.”

“I can get you all that information in a few days. Does that work for you?” he asked.

“Sure, Ron. Please get it to me as soon as possible, but don’t rush. Be thorough and honest,” I told him. “If the details match what you’ve shared, Chapter 7 might help you through this financial rough patch.”

“I hope so, Chris. I really need some relief. Just talking with you has already made me feel better,” he said. “I appreciate your time. I believe you can help me achieve financial freedom.”

Schedule a Consultation with our Dallas Firm to Learn About the Impact of Unemployment Overpayments on Chapter 7 Bankruptcy Proceedings in Texas

Filing for Chapter 7 Bankruptcy can be stressful and challenging, but you do not have to face it alone. Our team of experienced Dallas bankruptcy attorneys is ready to provide you with the guidance, support, and legal advocacy you need during these challenging times.

Whether you are trying to learn about the impact of unemployment overpayments on your Chapter 7 proceeding, or navigating any other bankruptcy issues, we are here to help you every step of the way. We welcome you to schedule a consultation to discuss your situation and case objectives. We can answer your legal questions and discuss how we can help you move forward. Call our law office at (888) 584-9614 or contact us online to schedule your consultation.