As a bankruptcy attorney here in Texas, it’s common for my clients to reach out to me soon after the dust has settled from their Chapter 7 bankruptcy cases. One afternoon, I received a call from Leon, a client I represented in his Chapter 7 bankruptcy case just six months earlier.

“Hey, Chris,” Leon began. “I’m feeling so much better now that those creditors are off my back. And I’ve been thinking, it’s time to fix up my kitchen and make some other home improvements. I’ve heard about these Home Equity Line of Credit (HELOC) loans. Do you think I can get one even though I still have that bankruptcy on my record?”

Leon’s question was one I’d heard before. A HELOC can be a good way to access funds, when you own your home, like Leon. However, I also knew that getting approved for a HELOC just months after a Chapter 7 bankruptcy discharge would be a significant challenge.

“Leon, I’m glad you reached out before just going to the bank and applying for a HELOC,” I replied. “While it’s possible to get a HELOC after bankruptcy, it’s not easy. Most lenders want to see a significant waiting period post-discharge before considering an application for a HELOC. But even then, they’re going to look closely at your credit score, income stability, and how you’ve managed your finances since the discharge.”

Leon sighed. “Yeah, I was afraid of that. I know my credit score took a bad hit and I’ve got to get it back up.”

“That’s exactly why I suggest focusing on credit rehabilitation first,” I said. “I’ve worked with clients in your position before, and one of the most effective ways to improve your credit score is by enrolling in a program like 720 Credit Score. It’s specifically designed for individuals recovering from bankruptcy. The program offers step-by-step guidance on rebuilding credit, from understanding how to manage new credit accounts responsibly, to learning what lenders are looking for when you apply for new loans.”

“That sounds like a lot of work Chris,” he said.

“Yes, it’s some work, but the rewards can speed up your financial recovery by increasing your credit score so you can get loans sooner, including that HELOC,” I told him. “Please let’s go over some details about getting a HELOC after a bankruptcy discharge and then we can build a path toward getting you those home improvements.”

Filing for Chapter 7 bankruptcy can result in feeling as if you’ve hit the reset button on your finances like Leon. It’s a significant step, often taken after careful consideration and usually when facing financial difficulties. But while a Chapter 7 bankruptcy can provide a much-needed fresh start, it can also raise questions about your future borrowing power.

A common question many individuals have is, “Can I get a HELOC after Chapter 7 discharge?” The answer, like many things related to finances and bankruptcy is, it depends.

There isn’t a simple yes or no response. Texas, like many states, has its own set of laws regarding both bankruptcy and lending practices. These come into play when you’re thinking about a HELOC (Home Equity Line of Credit) post-bankruptcy.

Can I Get a HELOC After Chapter 7 Discharge in Texas? Understanding the Basics

First, let’s supply a general overview of what Chapter 7 bankruptcy means. This type of bankruptcy, often referred to as “liquidation bankruptcy,” involves selling off non-exempt assets to pay creditors. In Texas, certain assets are protected from liquidation through Texas’ homestead exemption laws. If you file Chapter 7 bankruptcy, the bankruptcy trustee liquidates your assets, in other words sells them, and uses the proceeds to pay creditors according to the bankruptcy code. Once this process is complete, you receive a discharge, essentially wiping out eligible debts.

So, where do HELOCs fit into all of this? A HELOC is a loan that lets you borrow against the equity you’ve built up in your home. Equity represents the difference between what you owe on your mortgage and the market value of your house. So the more you’ve paid down your mortgage and the higher your home value, the more equity you have.

After a Chapter 7 discharge, meeting the eligibility requirements to secure a HELOC in Texas goes far beyond simply having equity in your home. Lenders want reassurance you can handle new debt responsibly. This gets challenging for someone who has a Chapter 7 bankruptcy on their record. It is a bankruptcy option for those struggling with debt payments, but securing loans afterward requires careful consideration of the bankruptcy process and its implications for your credit score.

Factors Influencing HELOC Approval After Chapter 7 in Texas

Here’s where understanding the interplay between Texas law and HELOCs is important. Texas law allows for homestead exemptions, protecting your home from creditors during bankruptcy proceedings. While this is good news for homeowners because you get to keep your home, obtaining a HELOC after Chapter 7 discharge in Texas requires a nuanced understanding of various state regulations.

Lenders want to make sure you are not taking on more debt than you can handle. Remember, lenders also consider state laws to protect their interests. They will assess your ability to repay based on factors such as your income, current debts, and creditworthiness.

A bankruptcy filing stays on your record for a set period, impacting all credit decisions, including obtaining a HELOC.

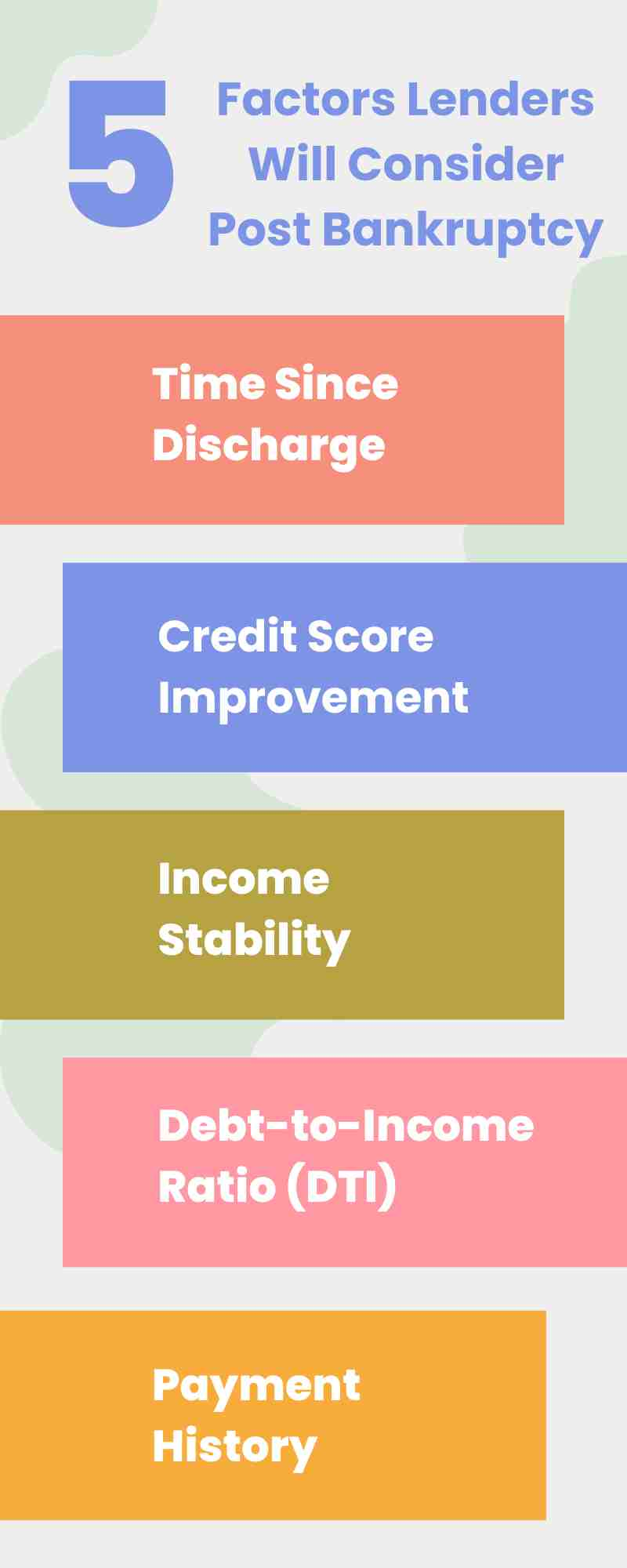

Here are some factors lenders will consider:

- Time Since Discharge: The longer it’s been since your Chapter 7 discharge, the better. A longer period of responsible financial management after bankruptcy demonstrates lower risk to a potential HELOC lender.

- Credit Score Improvement: While your credit score likely took a hit from the bankruptcy, rebuilding it shows lenders you’re committed to good financial habits. Even with a bankruptcy discharge on your record, a decent credit score after filing Chapter 7 bankruptcy can help.

- Income Stability: Lenders look for a steady income source to ensure you can manage HELOC payments. Provide documentation of your income, whether it’s from employment, self-employment, or other sources. The stability of your income plays a crucial role in securing a conventional loan or HELOC after bankruptcy.

- Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income that goes toward debt payments. A lower DTI is more favorable. Lenders use it to determine your ability to repay your debts.

- Payment History: Demonstrating a positive payment history since your discharge is crucial. This includes making on-time payments for existing loans, credit cards, and other bills. A good payment history shows lenders you’re serious about meeting your financial obligations. It helps establish trust with potential lenders.

Rebuilding Credit for HELOC Eligibility

While a Chapter 7 bankruptcy will stay on your credit report for a certain number of years, it doesn’t mean obtaining a loan, including a HELOC, in Texas is impossible. Demonstrating responsible financial behavior after your bankruptcy is essential to rebuild credit and increase your chances of loan approval.

Building a positive credit history, showing a stable income stream, and responsibly managing any existing debts will go a long way in showing potential Texas lenders you’re serious about financial responsibility. It’s important to demonstrate your commitment to responsible borrowing.

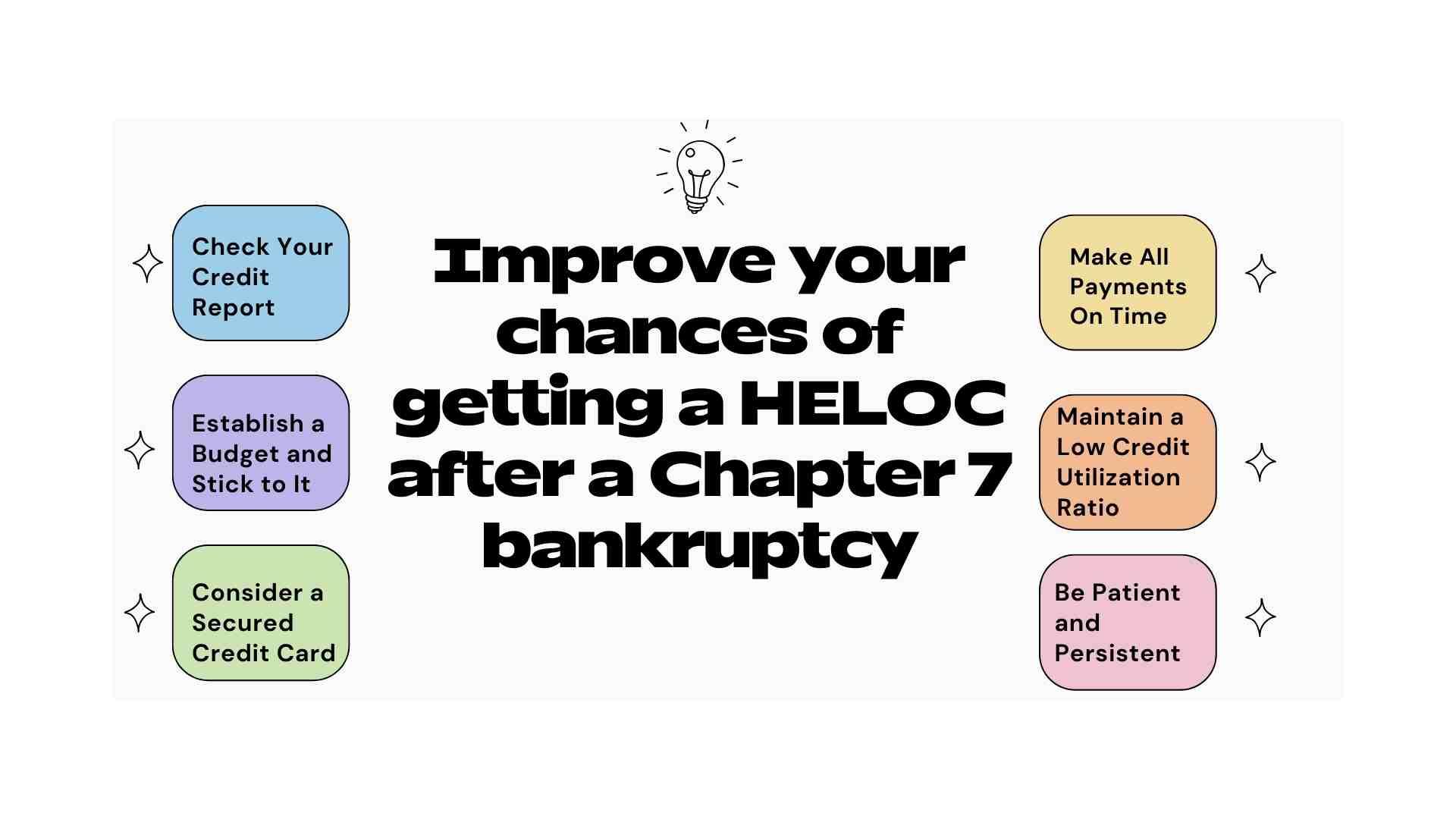

Here are some steps you can take to improve your chances of getting a HELOC after a Chapter 7 bankruptcy:

- Check Your Credit Report: Request a free copy of your credit report and review it carefully. Ensure accuracy and dispute any errors that could negatively impact your score.

- Establish a Budget and Stick to It: A well-managed budget demonstrates your ability to manage your income and expenses responsibly. Track your spending, identify areas where you can cut back, and allocate funds toward savings and debt repayment.

- Consider a Secured Credit Card: Secured credit cards are designed to help people with bad credit rebuild their credit history. These cards require a security deposit that typically becomes your credit limit.

- Make All Payments On Time: Timely payments are the most significant factor in improving your credit score. Set reminders or automate payments to avoid missed or late payments.

- Maintain a Low Credit Utilization Ratio: Keep your credit card balances low in relation to your credit limits. A high credit utilization ratio can hurt your score.

- Be Patient and Persistent: Rebuilding credit takes time and effort. Stay committed to your financial goals and don’t get discouraged if you don’t see immediate results.

Conclusion

So, can you get a HELOC after Chapter 7 discharge? The most accurate answer is that it’s challenging but possible. Texas homeowners should focus on rebuilding their credit and seek guidance from financial experts who understand post-bankruptcy lending.

Every financial situation is unique. Before making any decisions regarding HELOCs after Chapter 7 discharge, it’s recommended you seek advice from a qualified financial advisor or credit counselor. They can help assess your specific circumstances, including income level and any outstanding secured or unsecured debt. Based on your financial standing, they can guide you on when to apply for a loan or explore other loan options that might be suitable. Seeking expert guidance is essential, whether you are facing overwhelming financial challenges, or simply aiming to improve your financial journey.

Will Leon try to rebuild his credit with 720 Credit Score?

“Chris, I understand rebuilding my credit takes time and effort,” Leon said. “I get why the bank would be hesitant to give me that HELOC so soon after I just went through my bankruptcy. I can’t do anything to make time move faster but I can do something about my effort.”

“That’s right Leon,” I told him. “I see you’re being more responsible with your money just like we discussed. The banks will eventually be impressed with that but the one extra thing you can do to move their timeline along faster is to improve your credit score with a program like 720 Credit Score.”

“I thought I was all done with school Chris, but I actually see the value in a program like this. It’s not like I’ll be learning something for no apparent reason,” he said. “How long would it take until I can see the benefit of the program and get that HELOC?”

“Most clients see a significant improvement in their credit score within 12 to 24 months of actively working through the program. The key is consistency and showing lenders that you’re managing your finances responsibly post-bankruptcy. Once your credit score improves, you’ll not only have a better chance of getting approved for this HELOC you want, but also other loans, and even with better rates. It’s a totally worthwhile program.”

Leon paused, absorbing the information. “A year or two seems like a long time. You should see my kitchen. But I understand applying for a HELOC now might be a waste of time when I can spend my time getting into a better position for the bank to approve my application.”

“Yes, that makes sense Leon. Let’s focus on rebuilding your credit first, and when the time is right, we’ll confidently apply for that HELOC, knowing your chances of approval—and better terms—are much higher.”

“Okay, I’ll do it. I’ll enroll in the program.” Leon said as he left the call with a renewed sense of direction. I felt confident that once he participated in a credit rehabilitation program like 720 Credit Score, Leon would be on the right path toward getting that HELOC and fixing up his kitchen.

Schedule a Consultation with our Dallas Firm to learn about getting a HELOC after a Chapter 7 discharge

Bankruptcy and restoring your credit can be stressful and challenging, but you do not have to face it alone. Our team of experienced Dallas bankruptcy attorneys is ready to provide you with the guidance, support, and legal advocacy you need during these challenging times.

Whether you are wondering if you can get a HELOC after a Chapter 7 discharge, or navigating other bankruptcy issues, we are here to help you every step of the way. We welcome you to schedule a consultation to discuss your situation and case objectives. We can answer your legal questions and discuss how we can help you move forward. Call our law office at (888) 584-9614 or contact us online to schedule your consultation.