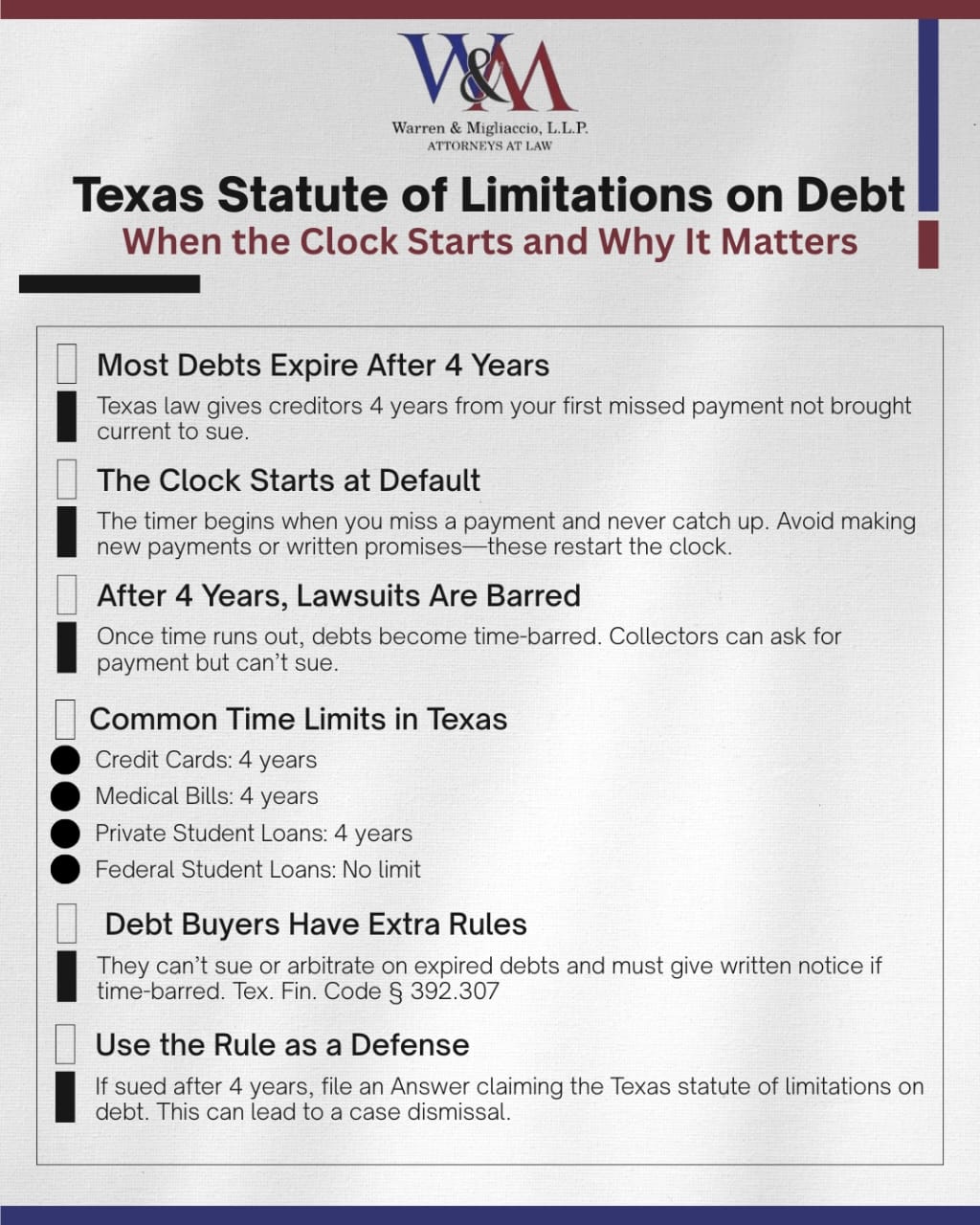

In Texas, the statute of limitations on most consumer debts starts when you default—your first missed payment that isn’t brought current—and generally runs four years, after which lawsuits are time-barred even though collectors may still request voluntary payment.

As an attorney specializing in debt and bankruptcy law in Texas, I often encounter clients who are unaware of how the statute of limitations affects their debts. Mr. Erving was one such client, only learning about it after getting sued.

On a rainy Tuesday afternoon, he called me, worried and confused. A creditor had just served him with a lawsuit demanding payment for old credit card debt. Unsure of his legal standing, he sought my help.

“Mr. Migliaccio,” he began, “I don’t understand how they can still sue me for this debt. It’s so old, I figured they forgot about it.”

I reassured him that seeking legal advice was the right step. I explained that the statute of limitations might be his best defense.

“The statute of limitations sets a time frame during which a creditor can legally sue to collect a debt. In Texas, for most debts, including credit cards, this period is four years from your default,” I said. “Let’s review how the statute of limitations applies to your case.”

For many people, like Mr. Erving, the fear of being sued for old debt can be overwhelming. But understanding the statute of limitations can empower you to regain control of your financial situation.

Quick Answer: When does the statute of limitations start on debt in Texas?

In Texas, limitations on most consumer debts begin at default and run four years; once expired, lawsuits are barred, so confirm your accrual date and avoid actions that could revive the claim.

- “Default,” in plain English: the first monthly payment you missed and never fully made up—this date usually starts the 4-year clock.

- Identify the first uncured missed payment from statements

- Avoid signing acknowledgments or sending new payments

- Request written validation of dates, balance, and the collector’s authority (see Reg F validation rules). 12 C.F.R. § 1006.34.

At Warren & Migliaccio, we handle debt collection lawsuits of all kinds. Whether it’s credit card debt, medical bills, or loans, our experienced debt defense attorneys are dedicated to protecting your rights. From navigating statute of limitations rules to building personalized defenses, we’ll help you take control of your financial future.

Understanding the Statute of Limitations for Debt

Grasping the concept of a statute of limitations for debt is crucial when dealing with unpaid debt in Texas. Essentially, it’s the timeframe during which creditors can legally pursue debtors to recover the owed amount through lawsuits.

Keypoints

- Texas limitations on most debts is four years from default.

- Default equals first missed payment not brought current.

- Signed acknowledgments can revive otherwise time-barred claims.

- Debt buyers cannot sue after limitations expire.

- Time-barred debts may still draw non-lawsuit collection requests.

Once this time limit expires, the creditor loses their right to take legal action against the debtor. However, it’s important to understand that the debt itself doesn’t disappear – you still owe the money, but the creditor can no longer sue you for it.

In Texas, the statute of limitations for most debts is four years, as outlined in Section 16.004 of the Texas Civil Practice and Remedies Code. But when exactly does this clock start ticking? That’s what we’ll explore in this post, along with the various types of debts covered and the implications of written contracts.

Types of Debts Covered Under the Statute of Limitations

Not all debts are created equal when it comes to the statute of limitations. Different types of debts have their own specific timeframes with different starting points. Let’s take a closer look at some common examples:

Credit Card Debt

Credit card debt typically falls under the standard four-year statute of limitations in Texas. This means that if you stop making payments on your credit card, the creditor generally has four years from your default (the first missed payment you never brought current) to sue you for the unpaid balance.

Medical Debt

Medical debt is a bit trickier. In Texas, the statute of limitations for medical debt is still four years. The claim generally accrues when payment is due and not made (a breach of the payment obligation), and the four-year period applies. Tex. Civ. Prac. & Rem. Code § 16.004(a). If you had a medical procedure and didn’t pay, the provider has four years to sue for unpaid debt. It’s crucial to track these dates, as medical bills can be delayed or overlooked.

Student Loans

Student loans are a different beast altogether with a complicated twist to keep in mind. Federal student loans have no statute of limitations for collection or suit under the Higher Education Act, 20 U.S.C. § 1091a(a). The government can come after you for unpaid student debt indefinitely. Private student loans, on the other hand, are subject to the same four-year limit as other types of debt in Texas.

If you have a mix of federal and private student loans, it’s crucial to understand and how the statute of limitations applies to each. Keep track of your promissory notes or loan agreements to have a record of the terms and conditions of your student debt.

When Does the Statute of Limitations Start?

Now that we’ve covered the types of debts subject to the statute of limitations, let’s dive into when exactly this clock starts ticking. In most cases, it’s the date of your first missed payment that you never made up (your default) that sets things in motion.

For example, let’s say you have a credit card with a balance of $5,000. You miss the next monthly payment and never bring the account current. The creditor then has four years from that missed-payment date to sue you for the remaining balance. If they don’t take legal action within that time frame, the debt becomes time-barred.

Beware of debt collectors who try to get you to acknowledge old debts. Making a small payment or sending a written acknowledgement can reset the statute of limitations clock. Be cautious when communicating with creditors or debt collectors about old debts, as it can have unintended consequences.

Sometimes determining the default date can be tricky, especially when a third-party collector has purchased the debt. You can request debt validation to clarify the timeline and confirm that you’re not being pursued for a debt that’s beyond the statute of limitations.

Here’s how we recently used these steps to shut down a time-barred lawsuit.

Case Study: Using the Statute of Limitations to Shut Down a Debt Lawsuit

A client came to me panicked after being served on an old store-card account. She felt embarrassed and afraid she’d lose her wages. I listened, then focused on the core question from this article: when did the clock start?

I pulled her statements, built a simple timeline, and sent a written validation request to the collector to confirm dates. We pinned down the first missed payment that was never brought current—more than four years ago. I filed an Answer asserting the statute of limitations defense and made sure she didn’t make any new payments or sign anything that could restart the clock. I also reminded the collector of their duties on time-barred debts.

The case was dismissed before trial, and the calls stopped.

Takeaway: Know your accrual date, request validation, and avoid actions that revive the claim. When the four-year Texas deadline has passed, a lawsuit can often be stopped.

Related: When Can Creditors Sue You in Texas? Deadlines, Defenses & Next Steps

Exceptions to the Standard Statute of Limitations

While the four-year statute of limitations applies to most debts in Texas, there are some exceptions that can alter or extend the standard statutory time frame.

One notable exception is for debts owed to the government, such as taxes or student loans. As mentioned earlier, federal student loans have no statute of limitations, meaning the government can pursue collection efforts indefinitely. Similarly, unpaid federal taxes can be collected for 10 years from the date of assessment. 26 U.S.C. § 6502(a)(1).

If you’ve accumulated credit card debt in another state, the statute of limitations might not be the same as it is in Texas. For instance, if you lived in a state with a longer time frame and then moved to Texas, the creditor could have more time to take you to court based on the original state’s laws. That’s why it’s essential to review your debt history and consider all the states you’ve lived in when determining how the statute of limitations applies to your situation.

Implications of Written Contracts on Statute of Limitations

When it comes to the statute of limitations, not all debts are treated equally. Debts that involve a written contract, such as a loan agreement or promissory note, may be subject to a different time frame than those without a written agreement.

In Texas, the statute of limitations for debts with written contracts is four years, similar to most consumer debts. However, the clock starts when the contract is breached, not from the date of default.

For example, let’s say you took out a personal loan with a written agreement to make monthly payments for three years. If you stopped paying after two years, the creditor would have four years from the date of your first missed payment to sue you for breach of contract.

Keeping track of written contracts related to your debts can be a lifesaver when it comes to understanding the fine print and potential legal implications. If you’re unsure about how a written contract affects the statute of limitations, don’t hesitate to seek guidance from a legal expert who can clarify your rights and responsibilities.

Potential Consequences for Pursuing Time-Barred Debt

Creditors and debt collectors might still try to chase you down for time-barred debts, despite the statute of limitations being on your side. But they should be warned, they could face consequences for these actions.

Debt collectors can’t sue or threaten to sue you over a time-barred debt, and if they do, you’ve got grounds to take them to court and claim damages and legal fees.

Debt buyers may not commence an action or initiate arbitration on a time-barred debt and must provide specified disclosures. Tex. Fin. Code § 392.307(b). This law, introduced in 2019, also requires debt buyers to provide written notice to consumers if they’re attempting to collect on a time-barred debt.

When a debt collector comes knocking, claiming you owe them a fortune, don’t panic. Stand firm and assert your rights. It’s a good time to consult with a consumer protection attorney to help you cut through the noise and avoid legal blunders.

Legal Requirements and Procedures in Debt Collection Lawsuits

Imagine a creditor or debt collector decides to take you to court over an unpaid debt. In Texas, there are specific legal requirements and procedures they must follow. Understanding these rules can help you mount a strong defense and ensure a fair shake in the legal system. The first step in dealing with legal action is getting served with a lawsuit. This official document, known as a complaint and summons, lets you know the creditor has taken legal action against you and outlines the specific reasons why.

The Justice court: answer is due by the end of the 14th day after service (Tex. R. Civ. P. 502.5(d)). County/District court: answer due on or before 10:00 a.m. on the Monday next after 20 days after service (Tex. R. Civ. P. 99(b)). has expired. Knowing about the statute of limitations, and understanding other legal defenses, can turn the case in your favor.

At trial, the creditor has the burden of proof to show you indeed owe the debt, the exact amount, and their legal right to collect. Expect them to present evidence like account statements, contracts, or payment records. But you can challenge their evidence and present your own case, including arguing that the debt is past the statute of limitations.

If the court finds in your favor, the creditor cannot continue to pursue legal action against you for that specific debt. If the creditor wins, they may be able to garnish your wages or bank accounts to satisfy the judgment, unless you appeal or negotiate a settlement.

Related: What Happens if a Debt Collector Takes You to Court? Possible Outcomes

Role of State Law in Debt Collection Cases

In Texas, debt collection gets a double dose of regulation. Federal laws like the FDCPA set the stage, but state-specific laws and regulations bring their own flavor to the table, influencing how debt collection cases unfold.

Take the Texas Debt Collection Act, for instance. This law is dedicated to shielding Texas residents from shady debt collectors who resort to unfair or deceitful tactics. No more misrepresenting debts, harassing debtors, or making empty threats of legal action.

Another important Texas law is the one we mentioned earlier regarding debt buyers and time-barred debts. This law, codified in Section 392.307 of the Texas Finance Code, prohibits debt buyers from suing on debts that are past the statute of limitations and requires them to provide specific disclosures to consumers.

Texas has no general borrowing statute for limitations; a narrow rule, § 16.067, applies to claims incurred before a person’s arrival in Texas. Tex. Civ. Prac. & Rem. Code § 16.067. This means that if you incurred a debt in another state with a shorter limitations period, that state’s timeline would apply, even if you’re now being sued in Texas.

Debt collection can be a minefield, especially when you’re not familiar with the laws specific to your state. In Texas, for instance, there are laws in place that provide additional safeguards and remedies. Don’t navigate these complex issues alone – work with a consumer protection attorney who knows the ins-and-outs of Texas debt collection law.

Importance of Seeking Legal Advice

Facing debt collection issues and potential lawsuits can be a huge burden, especially when you’re unsure about your rights and responsibilities. Consulting a qualified legal professional can help alleviate this stress and provide much-needed clarity.

A seasoned consumer protection attorney can be your guide through the maze of debt collection laws. They’ll help you grasp the statute of limitations and uncover any other legal defenses that apply to your situation.

In certain situations, an attorney can intervene on your behalf to hammer out a more favorable deal with creditors or debt collectors. If needed, they’ll also represent you in court, ensuring your rights are safeguarded every step of the way.

Before hiring an attorney, ensure they have a strong record in debt collection cases and understand relevant laws. Many consumer protection attorneys offer free consultations, so reach out to discuss your case. You can also seek guidance from the Consumer Financial Protection Bureau or a local legal aid organization.

The road to managing unpaid debt starts with knowing your rights. Familiarize yourself with the statute of limitations and get guidance from a pro – it’s the key to making informed choices and regaining control of your finances.

Key Takeaway:

In Texas, creditors generally have four years from default to sue for unpaid debts. Although the debt remains after this period, they lose their legal right to sue. Be careful, partial payments or written acknowledgments can restart this clock. Certain types of debt like federal student loans have different rules, and exceptions to the general four year rule apply, so be sure to get the proper legal guidance.

Frequently Asked Questions

FAQs About Texas Statute Basics

What is the statute of limitations on debt in Texas?

Texas generally allows four years to file a lawsuit for most consumer debts (credit cards, personal loans, retail accounts). After four years, the claim is time-barred from suit, though a collector may still request voluntary payment.

When does the 4-year clock start in Texas?

The clock typically starts at default—the first missed payment you didn’t bring current. Some open-account disputes reference last payment, but default is the safer anchor. Use statements and account history to confirm the accrual date.

FAQs About Revival and Debt Buyers

What can restart (revive) the statute of limitations in Texas?

Revival usually requires a signed, written acknowledgment of the debt’s “justness.” Be cautious with settlement letters or new agreements. Partial payments without a signed writing generally do not restart limitations.

Can a debt buyer sue me after the statute of limitations in Texas?

No. Once limitations expire, Texas law bars debt buyers from suing or starting arbitration and requires specific time-barred disclosures. Keep those notices and raise limitations promptly as a defense.

FAQs About Credit Reporting, Tolling, and Student Loans

Does the 7-year credit-report rule mean my debt is uncollectible?

No. Credit reporting timelines (often about seven years) are different from Texas’ four-year lawsuit deadline. A debt can fall off your report yet still be requested informally, and a reported debt may already be time-barred in court.

Are there exceptions that pause the 4-year clock (tolling)?

Sometimes. Limited tolling can apply—such as a bankruptcy stay or other statutory pauses. Texas courts have narrowed tolling for ordinary out-of-state absences, so verify facts and build a clear timeline before assuming extra time.

Do federal student loans have a statute of limitations?

No. Federal student loans have no statute of limitations for collection or lawsuits. Private student loans follow state-law limits, so Texas’ four-year period can matter for those.

FAQs About Collector Contact and Determining Time-Barred Status

What should I do if a collector contacts me about an old debt?

Request debt validation in writing and avoid signing anything that acknowledges the debt. Collectors cannot sue or threaten suit on time-barred accounts. Keep records of all calls and letters and respond in writing.

Can a creditor still contact me on a time-barred debt?

Yes, within limits. They may request voluntary payment, but suing or threatening suit on a time-barred account is prohibited. If the account was sold, Texas adds extra rules for debt buyers after limitations runs.

How do I figure out if my Texas debt is time-barred?

Build a quick checklist from your records:

- Date of first missed payment not brought current

- Any later payments or signed acknowledgments

- Assignment/sale dates between collectors

If sued, assert limitations as an affirmative defense in your Answer.

Conclusion

So, when does the statute of limitations start for debt? The answer isn’t always simple, but understanding the basics can make all the difference in your financial future. Whether you’re facing a lawsuit or just want to know your rights, the team at Warren & Migliaccio is here to help. We’ve seen firsthand the impact that debt can have on our clients’ lives, and we’re committed to finding solutions that work for you.

If you’re unsure whether your debts are too old for a lawsuit, it’s important to understand Texas’s statute of limitations. Consult a qualified attorney to determine if your debts are time-barred and get legal guidance. Remember, knowledge is power, and taking the right steps can help you avoid stress and financial hardship.

Don’t let fear or uncertainty hold you back from taking control of your debt. For more information, visit our website. You’ll find great resources there. Ready to start or talk to an attorney? Call our law office now at (888) 584-9614 or contact us online to schedule a consultation. Together, we can develop a plan to tackle your debt head-on and move forward with confidence. The road ahead may not be easy, but with the right support and guidance, you can overcome even the toughest financial challenges.

Did the Statute of Limitations Help Mr. Erving?

Mr. Erving absorbed the information and asked, “So, if I haven’t made a payment in more than four years, they can’t sue me?”

“That’s right, though it’s not that simple,” I replied. “If more than four years have passed since your default, the debt is considered time-barred, and the creditor can’t enforce it through a lawsuit. You’d have a strong defense. However, make sure you didn’t make a partial payment or acknowledge the debt in writing, as this would reset the statute of limitations.”

He sighed. “The last four years, really more than that, are a blur for me. Especially financially.”

“Well, to determine if the debts are time-barred, we’ll need to clear that blur and gather details,” I said. “Can you collect any documentation related to the debts—payment records, statements, correspondence with creditors?”

He agreed to try and round them up. Once he provided the documents, we reviewed them and saw that the last payment on the credit card debt had been made over five years ago.

“Good news,” I informed him. “Based on this, the debts appear to be past the statute of limitations, which means you have a strong defense against the lawsuit. However, it’s essential to respond to the lawsuit properly to assert this defense. Keep in mind, creditors may have their own evidence, so we shouldn’t be overconfident yet. Let’s file an answer to the lawsuit, stating the debts are time-barred under Texas law, and see how the court responds. If it turns out the case isn’t time-barred, we still have plenty of other legal tools to defend you.”

Schedule a Consultation with our Dallas Firm to Learn When the Statute of Limitations Starts on your Debt

Debt collection lawsuits can be stressful and challenging, but you do not have to face it alone. Our team of experienced Dallas debt defense attorneys is ready to provide you with the guidance, support, and legal advocacy you need during these challenging times.

Whether you are trying to learn about the Statute of Limitations or navigating other debt collection issues, we are here to help you every step of the way. We welcome you to schedule a consultation to discuss your situation and case objectives. We can answer your legal questions and discuss how we can help you move forward. Call our law office at (888) 584-9614 or contact us online to schedule your consultation.