As an attorney specializing in debt defense and bankruptcy law in Texas, I often meet clients with limited income who are overwhelmed by debt. It’s not because they’ve made poor financial choices but because of the rising cost of living. Many, like Wilson, don’t want to file for bankruptcy—they just need guidance on how to manage debt with their current income.

“Chris, I can’t even check the mailbox without feeling anxious. There’s always another bill,” Wilson confided. “I’m not a deadbeat, but inflation and new expenses—like internet and cell phone bills—just weren’t part of my parents’ lives. There’s too much that’s now considered essential.”

“I hear you, Wilson,” I said, understanding how common his situation is. “Tell me more.”

“I keep putting everything on credit cards. My kids love playing soccer, but the costs—uniforms, ref fees, tournaments—are crushing. It all goes on the credit card I can’t pay off. And now I might need dental work and medical procedures that insurance probably won’t cover. It’s not like I’m going on vacations or fancy dinners,” he added.

“Wilson, this is a common story in Texas. That’s why I’ve put together a guide with ten strategies for people in your situation—limited income, but too much debt,” I told him. “Let’s walk through it.”

“Sounds great. Let’s get started,” he said.

Getting out of debt on a tight budget like Wilson’s may seem tough, but it’s possible. This guide will walk you through proven methods to reduce your debt, from creating a manageable budget to negotiating with creditors. No matter your financial situation, there’s hope for a debt-free future.

Understanding Your Debt Situation

Before diving into debt repayment strategies, it’s important to get a clear picture of your current financial state. This step is fundamental before you start learning how to get out of debt on a low income.

Take Inventory of Your Debts

Start by listing all your debts:

- Credit card balances

- Personal loans

- Student loans

- Medical bills

- Any other outstanding debts

For each debt, note down the creditor, total amount owed, interest rate, and minimum monthly payment. This inventory will serve as your financial roadmap.

Calculate Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a key indicator of your financial health. To calculate it, add up all your monthly debt payments and divide by your gross monthly income. For example, if your monthly debt payments total $1,000 and your gross monthly income is $3,000, your DTI would be 33%.

A lower DTI is generally better, with most financial experts recommending keeping it below 36%.

Review Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus. You can get one free credit report annually from AnnualCreditReport.com. Review these reports carefully looking for any errors or discrepancies that could be impacting your credit score.

Creating a Realistic Budget

A well-planned budget is your most powerful tool when figuring out how to get out of debt on a low income. A budget helps you understand where your money is going and where you can cut back to save money.

Track Your Income and Expenses

Start by listing all sources of income, including your primary job, any side hustles, and other regular payments you receive. Then, track all of your expenses for a month. This includes fixed costs like rent and utilities, as well as variable expenses like groceries and entertainment.

Categorize Your Spending

Divide your expenses into categories to help you create a monthly payment plan:

This breakdown will help you identify areas where you can potentially cut back. To maintain smart money habits, it is important to have an accurate picture of where your money is going.

Implement the 50/30/20 Rule

Consider adopting the 50/30/20 budgeting rule:

- 50% of your income goes to necessities

- 30% to wants

- 20% to savings and debt repayment

If your income is low, then you might need to adjust these percentages, possibly allocating more towards necessities and debt repayment. By prioritizing debt repayment in your budget, you’re actively working towards a debt-free future.

Strategies to Increase Your Income

While budgeting is crucial, increasing your income can significantly accelerate your debt repayment journey. Here are some strategies to boost your earnings.

Explore Side Hustles

In today’s gig economy, there are numerous opportunities to earn extra cash outside your regular job. Consider the following:

- Freelancing in your area of expertise

- Driving for ride-sharing services

- Delivering food or groceries

- Pet-sitting or dog-walking

- Tutoring or teaching online

Sell Unused Items

Do you have any items around your home that you no longer need? Selling these can provide a quick influx of cash to put towards your debt. Platforms like eBay, Facebook Marketplace, or local consignment shops can be great places to sell them and earn some extra income.

Negotiate a Raise or Seek Better Employment

If you’ve been at your job for a while and have been performing well, consider asking for a raise. Alternatively, look for higher-paying job opportunities that match your skills and experience. Getting a better paying job could improve your financial situation significantly.

Take Advantage of Tax Refunds and Windfalls

When you receive unexpected money, such as a tax refund or a gift, resist the temptation to splurge. Instead, put this money directly towards your debt. According to a LendingTree study, more than seven out of 10 people receive a refund when they file their annual taxes – and these refunds are typically thousands of dollars each.

Effective Debt Repayment Strategies

Now that you’ve got a handle on your finances and have explored ways to increase your income, let’s turn to some specific strategies for getting out of debt on a low income. Choosing the right debt repayment strategy can make a significant difference in how quickly you become debt-free.

The Debt Snowball Method

The debt snowball method, popularized by financial expert Dave Ramsey, focuses on paying off your smallest debts first while making minimum payments on larger debts. Here’s how it works:

- List your debts from smallest to largest.

- Pay the minimum on all debts except the smallest.

- Put any extra money towards the smallest debt.

- Once the smallest debt is paid off, move to the next smallest.

This method provides quick wins, which can be motivating and help build momentum in your debt repayment journey.

The Debt Avalanche Method

The debt avalanche method prioritizes paying off debts with the highest interest rates first. Here’s the process:

- List your debts from highest to lowest interest rate.

- Pay the minimum on all debts except the one with the highest rate.

- Put any extra money towards the highest-interest debt.

- Once that’s paid off, move to the debt with the next highest rate.

This method can save you more money in interest over time, but may not provide the quick wins of the snowball method. It’s essential to have a clear understanding of your interest rates to effectively use this method.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan, ideally with a lower interest rate. This can simplify your payments and potentially save you money on interest. Options include:

- Personal loans

- Balance transfer credit cards

- Home equity loans (if you’re a homeowner)

Be cautious with this approach and make sure you understand all terms and fees before proceeding. Debt consolidation can be a helpful tool but it’s crucial to use it wisely.

Negotiating with Creditors

Don’t be afraid to reach out to your creditors to negotiate. Many are willing to work with you, especially if you’re proactive about addressing your debt.

Ask for Lower Interest Rates

If you have a good payment history, call your credit card companies and ask for a lower interest rate. Even a small reduction can save you significant money over time. By negotiating a lower interest rate, you’re effectively reducing your overall debt burden.

Request a Hardship Plan

If you’re facing temporary financial difficulties, ask about hardship programs. These might include:

- Temporarily reduced payments

- Waived fees

- Lower interest rates

Remember, creditors would rather work with you than risk you defaulting on your debt entirely.

Debt Settlement

In some cases, creditors might be willing to settle your debt for less than what you owe. This is typically a last resort because it can have significant impacts on your credit score. If you’re considering this option, it’s wise to consult with a financial advisor or credit counselor first to learn about the long term consequences.

Exploring Government Assistance Programs

When you’re trying to figure out how to get out of debt on a low income, don’t overlook potential government assistance programs. These programs can provide valuable support and free up more of your income for debt repayment.

Supplemental Nutrition Assistance Program (SNAP)

SNAP, formerly known as food stamps, helps low-income individuals and families afford nutritious food. Eligibility is based on income and family size.

Low Income Home Energy Assistance Program (LIHEAP)

LIHEAP can help with heating and cooling costs, bill payment assistance, energy crisis assistance, and energy-related home repairs.

Women, Infants, and Children (WIC)

WIC provides supplemental food and more to low-income pregnant women and mothers, as well as children up to age 5. This program can significantly reduce food costs for eligible families.

Medicaid and Children’s Health Insurance Program (CHIP)

These programs provide free or low-cost health coverage to eligible low-income individuals and families. Remember, eligibility for these programs varies by state and individual circumstances. To find out what assistance might be available to you, consider calling or texting the 211 Network, which can help you find available help near you.

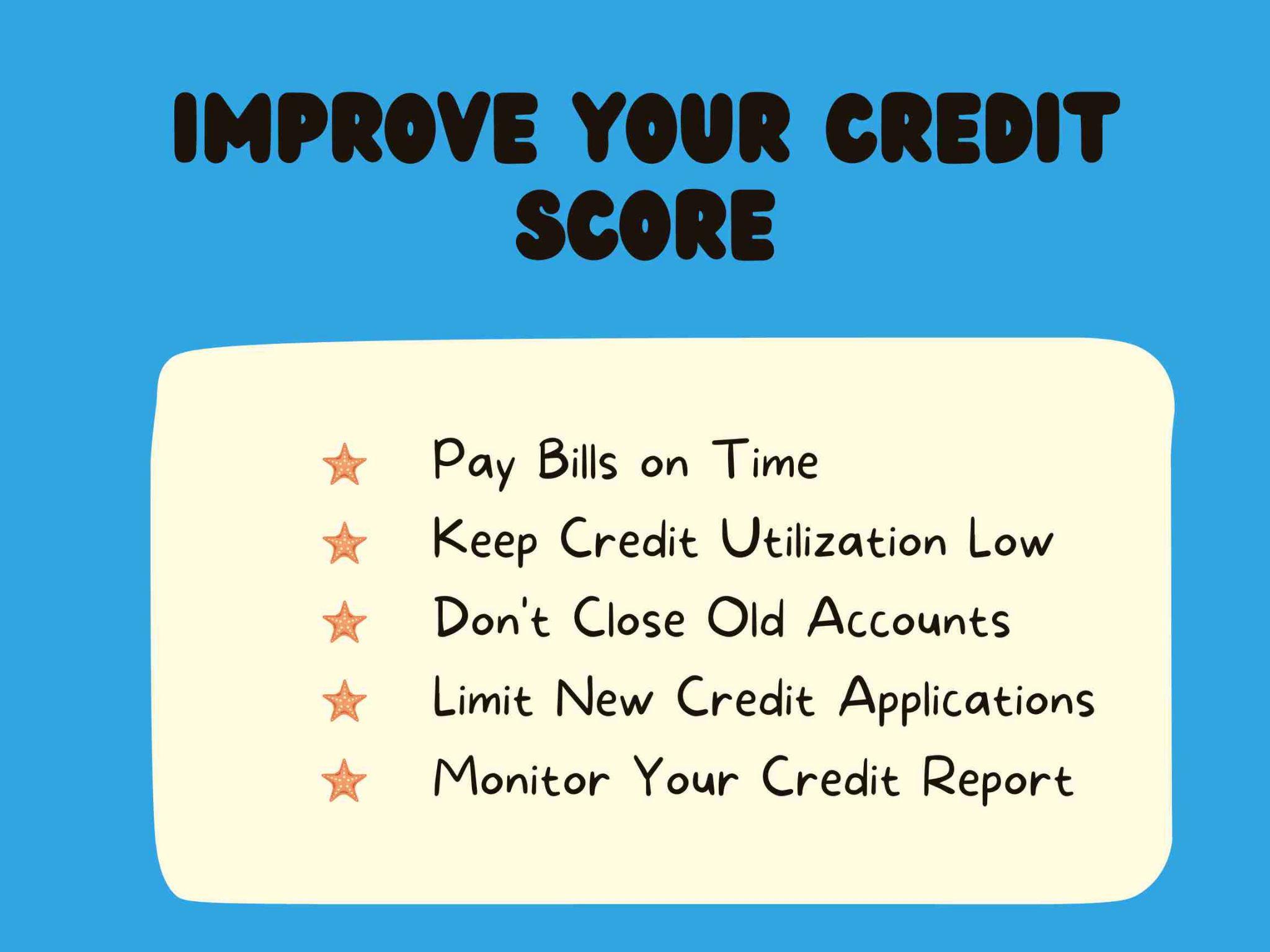

Improving Your Credit Score

While you’re working on paying off debt, it’s also important to focus on improving your credit score. A better credit score can lead to lower interest rates on future loans or credit cards, potentially saving you money in the long run. It’s essential to be mindful of factors that can impact your credit score, such as making on-time payments and keeping your credit utilization low.

Pay Bills on Time

Payment history is the most significant factor in determining your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Keep Credit Utilization Low

Try to keep your credit card balances below 30% of your credit limit. If possible, aim for even lower – around 10% is ideal.

Don’t Close Old Accounts

The length of your credit history matters. Keep old accounts open, even if you’re not using them regularly.

Limit New Credit Applications

Each time you apply for credit, it results in a hard inquiry on your credit report. Too many of these can negatively impact your score.

Monitor Your Credit Report

Regularly check your credit report for errors or signs of identity theft. If you find any inaccuracies, dispute them promptly.

Considering Bankruptcy as a Last Resort

While often seen as a last resort, bankruptcy can be a viable option for some individuals struggling with overwhelming debt. It’s important to understand that bankruptcy is not a decision to be taken lightly, but in certain situations, it can provide a fresh start.

Types of Bankruptcy

There are two main types of bankruptcy for individuals:

- Chapter 7 Bankruptcy: This type of bankruptcy liquidates your assets to pay off debts. Many debts are completely discharged, giving you a fresh start.

- Chapter 13 Bankruptcy: This involves restructuring your debts into a 3-5 year repayment plan. It allows you to keep your assets while paying off a portion of your debts.

Pros of Bankruptcy

- Immediate relief from creditor harassment

- Discharge of many unsecured debts

- Opportunity for a fresh financial start

Cons of Bankruptcy

- Significant negative impact on credit score

- Difficulty obtaining credit in the future

- Potential loss of assets (in Chapter 7)

- Bankruptcy stays on your credit report for 7-10 years

When to Consider Bankruptcy

You might consider bankruptcy if:

- Your debts are more than 50% of your annual income

- It would take more than five years to pay off your debt, even with extreme budget cuts

- Your debt is seriously impacting your quality of life and mental health

If you’re considering bankruptcy, it’s crucial to consult with a bankruptcy attorney or credit counselor to understand all implications and alternatives.

FAQs about how to get out of debt on a low income

How do you get out of debt when you’re poor?

Getting out of debt on a low income requires a combination of strategies. Start by creating a strict budget, cutting unnecessary expenses, and looking for ways to increase your income through side hustles or better employment. Consider debt repayment methods like the snowball or avalanche method. Don’t hesitate to negotiate with creditors or explore government assistance programs. Remember, it’s a gradual process that requires patience and persistence.

How to pay $30,000 debt in one year?

Paying off $30,000 in debt within a year on a low income is challenging but not impossible. It would require drastic measures such as significantly increasing your income through multiple jobs or side hustles, cutting living expenses to the bare minimum, and potentially selling valuable assets. You might also consider debt consolidation or negotiating with creditors for lower interest rates. Remember, this aggressive approach may not be sustainable for everyone, and a longer-term plan might be more realistic.

How do I get out of debt when my bills are more than my income?

When your bills exceed your income, immediate action is crucial. Start by prioritizing essential expenses like food, shelter, and utilities. Contact your creditors to explain your situation and negotiate lower payments or interest rates. Look for ways to increase your income and reduce expenses drastically. Consider seeking help from a credit counseling agency or exploring debt relief options. In severe cases, bankruptcy might be an option, but should be considered as a last resort after consulting with a financial professional.

What to do if you’re broke and in debt?

If you’re broke and in debt, focus first on meeting your basic needs. Reach out to creditors to explain your situation and explore hardship programs. Look into government assistance programs for food, housing, and healthcare. Try to increase your income through any means possible, even if it’s temporary work. Create a bare-bones budget, eliminating all non-essential expenses. Consider selling items you don’t need. If the situation is severe, seek advice from a non-profit credit counseling agency to explore all your options, including debt management plans or, as a last resort, bankruptcy.

Conclusion

Learning how to get out of debt on a low income is challenging, but it is possible. It requires dedication, patience, and a willingness to make tough choices. Remember, every small step you take – whether it’s cutting an unnecessary expense, negotiating a lower interest rate, or picking up a side gig – brings you closer to your goal of financial freedom.

Don’t be discouraged if progress seems slow at first. Debt repayment is a marathon, not a sprint. Celebrate your small victories along the way, and don’t hesitate to seek help when you need it, whether from a financial advisor, a credit counselor, or supportive friends and family.

By implementing the strategies we’ve discussed – from creating a realistic budget and exploring debt repayment methods to negotiating with creditors and improving your credit score – you’re taking control of your financial future.

Stay committed to your plan, be open to adjusting your approach as needed, and remember that becoming debt-free is not just about the destination, but also about the financial habits and knowledge you gain along the journey. With persistence and the right strategies, you can overcome your debt, even on a low income. Your future self will thank you for the hard work and sacrifices you’re making today. Keep pushing forward, and financial freedom will be within your reach.

Did this Guide Help Wilson?

“Chris I thought I was doing everything right, maintaining a steady job, not spending on fancy things we didn’t need,” Wilson paused before he said, “But maybe we could, I mean we could change some things.”

“Wilson, it looks like my guide gave you some ideas? Tell me, what are you thinking?” I said.

“I mean we have a basement full of baby and toddler stuff. And my old stuff too. Really we’ve got so much stuff down there,” he said. “We could clean it out and sell all the stuff at a garage sale. That could bring in 1,000’s right away and maybe become an on-going side hustle using one of those social media platforms.”

“Now you are talking, what else?” I encouraged him.

“If we clean out the basement, I could rent it out. It’s almost a small apartment, with a bathroom and kitchenette,” he continued. “And I should probably ask for a raise—or look for a new job. I’m overqualified for the work I’ve been doing for years. It’s time to earn more.”

“Wilson, you’ve got the tools to get out of debt,” I told him. “You may not need a lawyer yet. There are financial moves you can make before resorting to legal measures. Keep me posted if any creditors sue you—I’ll defend you. But I think you’ll get things straightened out before it comes to that. The next time we talk, I bet it’ll be about that estate plan you’ve been putting off.”

“Thanks, Chris. You’ve really helped today. I’m confident I can get out of debt with hard work,” Wilson said with a smile. “Forget bankruptcy, let’s focus on that estate plan instead.”

Schedule a Consultation with our Dallas Firm to Learn How to Get Out of Debt on a Low Income

Struggling with overwhelming debt while earning a low income can be stressful and challenging, but you do not have to face it alone. Our team of experienced Dallas debt defense attorneys is ready to provide you with the guidance, support, and legal advocacy you need during these challenging times.

Whether you are trying to learn how to get out of debt on a low income or navigating other debt related issues, we are here to help you every step of the way. We welcome you to schedule a consultation to discuss your situation and case objectives. We can answer your legal questions and discuss how we can help you move forward. Call our law office at (888) 584-9614 or contact us online to schedule your consultation.