Facing a lawsuit is scary. It can feel like the walls are closing in. Many people wonder, can debt consolidation stop a lawsuit, especially when dealing with credit card debt? This is a complex question with no easy answer. Let’s break down what debt consolidation is and how it might impact a creditor lawsuit.

Debt consolidation won’t automatically stop a lawsuit if you’re already facing legal trouble. There’s no guarantee consolidating debt will halt an existing lawsuit. It’s essential to consult with a bankruptcy attorney for effective debt relief options and address your total debt.

Can Debt Consolidation Stop a Lawsuit?

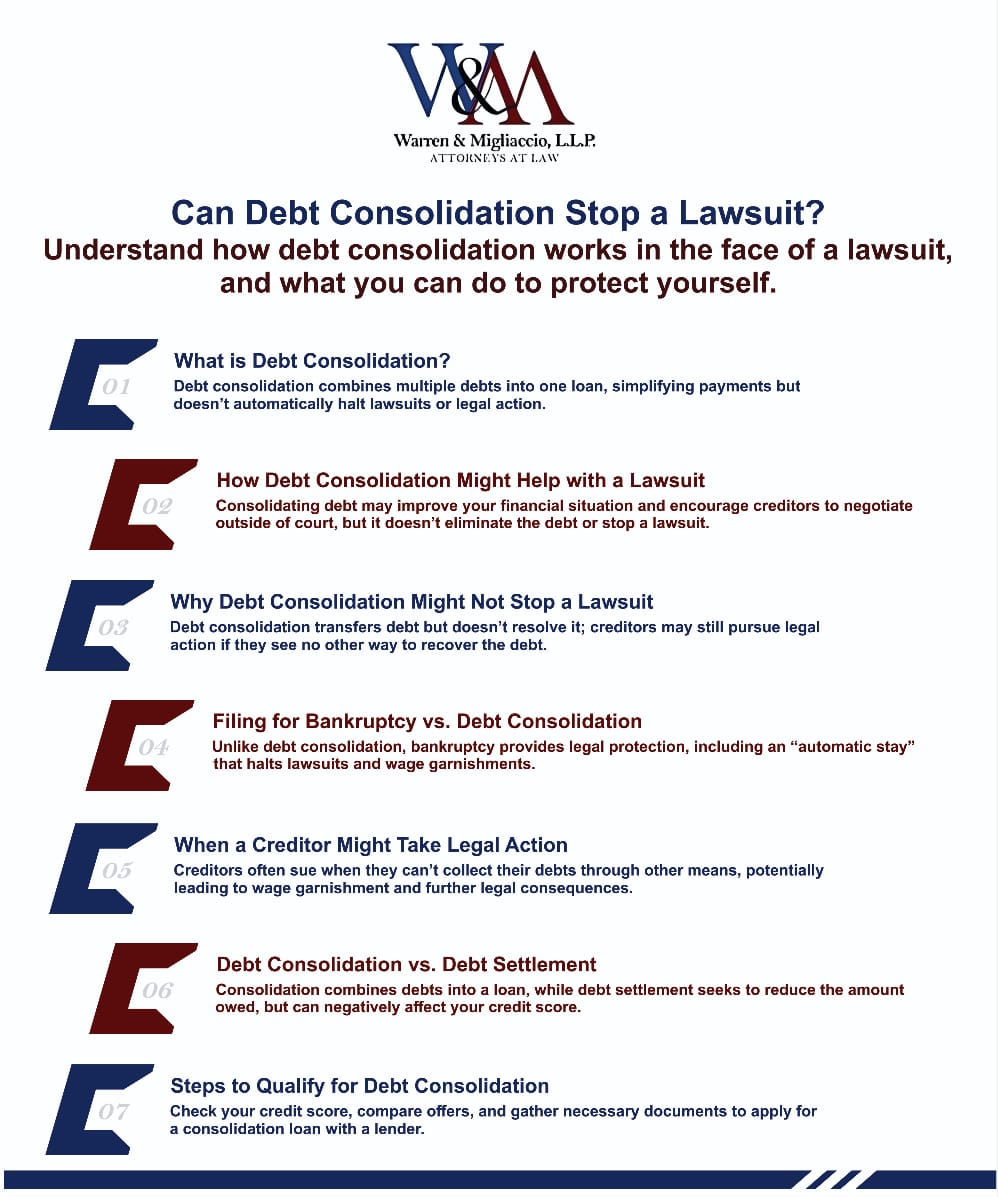

Debt consolidation combines several debts into a single, new loan. This simplifies monthly payments and potentially lowers interest rates. It can provide structure and make managing debt more straightforward. But, it’s crucial to understand how consolidation interacts with legal proceedings and debt collection agencies.

Understanding Debt Consolidation

Debt consolidation involves securing a loan to pay off multiple debts. It is often facilitated by debt settlement companies. This creates one new payment. Debt consolidation streamlines finances. However, its impact on a pending or potential lawsuit is nuanced and can involve a repayment plan.

How Debt Consolidation Might Help with a Lawsuit

Debt consolidation can improve your financial standing. It is especially helpful in unsecured debt and unsecured debts like medical bills and credit card bills. In some cases, this may influence a debt collector to be more willing to negotiate a debt consolidation program with a debt settlement agency. Settling outside of court saves everyone money and time.

A debt consolidation loan simplifies repayment. It doesn’t erase the debt itself. A lawsuit continues as long as the underlying debt remains, even with a debt management plan. Get assistance from your state attorney general or a credit counselor.

Why Debt Consolidation Might Not Stop a Lawsuit

Even with debt consolidation, the original debt is just transferred, not resolved through a debt relief program or debt settlement plan. The original creditor may see a lawsuit as their only way to recover their money. They may move forward even if your debts are consolidated through a debt management plan.

Sometime, the debt settlement company promises a fast escape but leaves clients in legal trouble. Be sure to get legal advice on a proper payment plan to solve total debts so you avoid legal challenges from debts you’re seeking more than just help with.

Filing for bankruptcy stops lawsuits, includes lawsuit protections from creditors, and creates an “automatic stay.” Consolidation cannot provide this specific legal protection, which includes protection from wage garnishments. Find out more about bankruptcy filing.

When a Creditor Might Take Legal Action

Creditors often sue when they see no other recourse for collecting your total debts. These legal actions are typically considered after evaluating your financial situation and overall total debt.

A lawsuit can result in wage garnishments. Before working with a company, vet them using resources like the Better Business Bureau. Review first-hand experiences online.

| Action | Potential Outcome |

|---|---|

| Ignoring a Lawsuit | Default judgment (the court sides with the creditor). This leads to serious financial consequences like wage garnishment and damage to your credit report. |

| Negotiating a Settlement | Possible dismissal of the lawsuit after reaching a mutually agreeable resolution with the creditor, perhaps through a partial payment. This may halt further collection efforts. |

| Challenging the Lawsuit (with an attorney) | Potentially beneficial if the debt is invalid, inaccurate, or beyond the statute of limitations. This may lead to a better settlement or winning the bankruptcy case. |

Debt Consolidation vs. Debt Settlement

Debt consolidation combines debts into a new loan, typically aiming for a lower interest rate. You still repay the full amount.

Debt settlement seeks to pay off debt for less than what’s owed, sometimes using a lump-sum payment through settlement companies. The debt settlement process can impact your credit report negatively. It requires a detailed settlement plan with a clear payment plan. However, restructuring debt with a loan offers more opportunities to fix financial problems and might prevent future lawsuits.

Steps To Qualify for Debt Consolidation:

- Check Credit Score.

- Research Lenders.

- Compare Offers/Rates/Fees.

- Complete Loan Application.

- Complete Needed Legal Documents (tax forms, bank statements, ID, and paystubs).

- Successfully Get Lender Approval (sometimes through a p2p lender).

Frequently Asked Questions

How can a debt lawsuit be dismissed?

A debt lawsuit can be dismissed in several ways:1. Prove the debt isn’t yours2. Show the debt is past the statute of limitations3. Negotiate a settlement with the creditorSettling may involve making a smaller lump-sum payment, often as part of a debt settlement program offered by a settlement company. Also, filing for bankruptcy can dismiss lawsuits through an “automatic stay,”. Ultimately, halting most collection efforts.

Will debt consolidation stop garnishment?

Debt consolidation alone won’t stop wage garnishment if a court order has already been issued. But, proactive debt consolidation could deter creditors from pursuing garnishment, especially if it demonstrates a good faith effort to address your debt. This is particularly important if it involves managing personal loans before a court ruling for default.

How do I stop a debt collection lawsuit?

1. Officially respond to the lawsuit2. Seek guidance from a lawyer specializing in debt collection3. Consider negotiating or settling through debt settlement servicesFiling for bankruptcy is a last resort, but you can consult a law firm for help managing unsecured debts, including student loans.

What is better, debt settlement or consolidation?

The best option depends on your specific situation:1. Debt consolidation preserves your credit score but may result in higher payments.2. Debt settlement, facilitated by a debt settlement agency, lowers repayment amounts. But can negatively impact your credit score. It may take longer to reach debt freedom, though it can offer more immediate relief.Debt settlement services like National Debt Relief may offer attractive alternatives to bankruptcy. Hence, providing solutions such as lower payments and quicker debt resolution.

Conclusion

Can debt consolidation stop a lawsuit? It’s complicated. While consolidating can improve your financial situation, it’s not a guaranteed shield against legal action.

Talk to a legal expert about options like bankruptcy. They can guide you toward an effective debt relief solution for your situation. Can debt consolidation stop a lawsuit is a complex question requiring personalized guidance.

Consulting with a legal expert can provide the guidance you need, whether it’s filing for bankruptcy or negotiating a settlement. Our experienced lawsuit defense attorneys are ready to help you navigate your debt relief options. Give us a phone call at (888) 584-9614 or reach out online to start exploring your path to financial relief today.