As an experienced family law attorney here in Texas, I understand how much my divorce clients think they know about property division as well as how little they really do know. They often think it’ll be a breeze but they soon find out there’s a lot more to know about Texas property division law than they think. Penny illustrates the point.

“So Chris, it’s going to be 50/50 on the property, right?” Penny asked me at our first meeting.

“Well, not necessarily Penny. There’s a lot that goes into property division,” I told her. “50/50 is an okay way to think about it in general, but there’s a lot of detail, it doesn’t always come out that way. You can’t just think I’m getting half.”

“What’s the detail? Why’s it so complicated?” she asked.

“Penny, if you and your soon-to-be-ex want a 50/50 split, and you agree, we can make it work pretty close to that way, but if you start arguing, and you get lawyers, and the court involved, it won’t be so simple,” I explained.

“Oh, we’re already arguing. And I’m worried he’s going to want some of my inheritance. He’s blaming the whole divorce on my inheritance,” she explained. “He thinks I was planning to leave him for years, just waiting for my father’s money, and once I got it, that’s when I told him I was leaving.”

“That happens sometimes Penny. So whether it has tipped the scales for you or not, there’s a lot you need to learn about property division in Texas,” I said. “Please allow me to go over seven fundamental questions people should ask about property division in a Texas divorce. I want you to pay specific attention to the part about inheritance.”

“Okay, Chris, I’ll pay attention,” she said.

Why a 50/50 Split Isn’t Always Guaranteed

When it comes to a Texas divorce, one of the biggest worries for people like Penny is how to split up property and debt. As an attorney who has guided many clients through the Texas divorce process, I know how important it is to clarify how marital assets (and liabilities) are divided.

Divorce can be stressful, especially when your future feels uncertain. My goal in this article is to explain how property division in a Texas divorce works and answer some of the most common questions you may have to alleviate that stress.

Below, we’ll explore the Top 7 Questions About the Division of Property in a Texas Divorce, using a simple outline to help you understand the law, your rights and the practical steps involved. Since Texas is a community property state, understanding how property is characterized—and what is considered community property versus separate property—is key to making sure you get a fair result. In community property states like Texas, both spouses own community property and are responsible for community debts. Texas community property laws govern this division, generally assuming that property acquired during marriage belongs to both spouses. Understanding these laws is crucial when going through divorce.

Introduction

Dividing assets and debts is one of the toughest parts of a divorce. You need to split everything from retirement accounts to real estate. This must be done according to Texas law and your specific situation.

Texas is a community property state. This means most property acquired during marriage belongs to both spouses. It is therefore part of the “community estate.” According to Texas community property laws, community property includes any assets or debts acquired during marriage. This property must be divided equally during a divorce.

Why is this important? Understanding the property division process can help you:

- Protect what’s yours

- Avoid costly mistakes

- Plan for the future

Texas courts don’t always split everything 50/50. Courts aim for an “equitable” or fair division. They consider factors like:

- Length of the marriage

- Each spouse’s financial situation

By knowing how Texas views and categorizes marital assets, you’ll be better prepared. You can negotiate or advocate for a fair outcome in your divorce.

Source: mcclure-lawgroup.com

Source: mcclure-lawgroup.com

Question #1: What Is Property Division Under Family Law in a Texas Divorce?

Property Division Under Family Law in a Texas Divorce

In a Texas divorce, property division means the legal process of categorizing, valuing and splitting the couple’s marital estate. Under the Texas Family Code, the marital estate generally includes assets, debts and other financial interests either spouse acquired from the date of marriage until the date of divorce.

It’s important to note that the divorce process itself triggers the characterization (or identification) of which assets are community property and which are separate property. Marital property can include homes, vehicles, bank accounts, retirement savings and even business interests. Once the marriage is over, all community property is divisible, while each spouse’s separate property should stay with that spouse.

Texas Law on Marital Property and the Texas Family Code

The Texas Family Code provides the legal framework for how marital estates are divided during a divorce. It sets rules for what is community property, community debt and personal property (a spouse’s separate estate). Texas community property law says that property acquired during marriage is generally community property which affects the division of assets during a divorce. For example:

- Community assets: Anything acquired by either spouse during the marriage (with limited exceptions).

- Community debt: Liabilities or obligations incurred during the marriage, such as mortgages or auto loans used for marital purposes.

- Separate property: Assets owned before marriage, gifts, inheritances and certain personal injury awards received during marriage.

Community Property State vs. Equitable Distribution

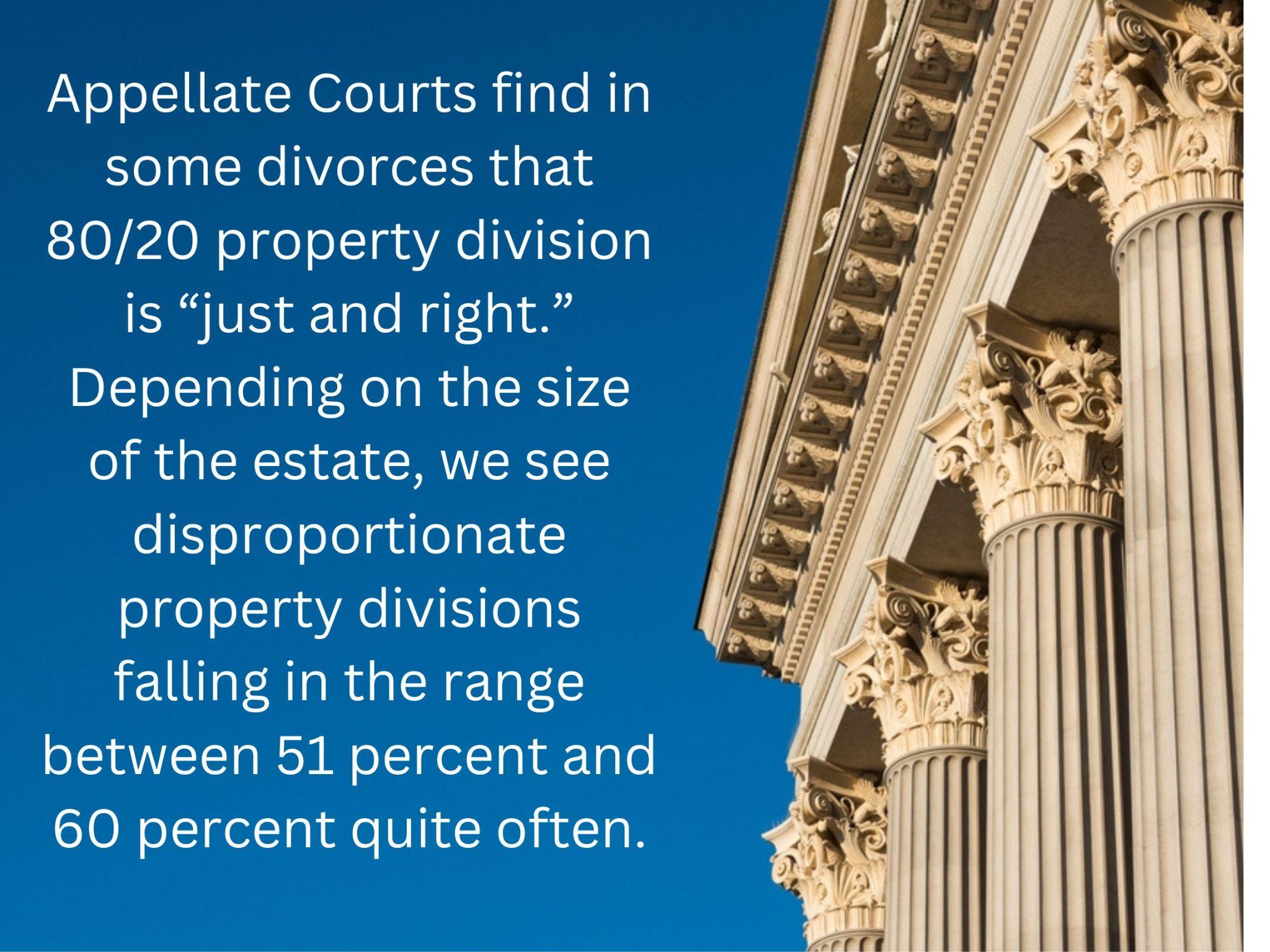

Texas is a community property state but this doesn’t mean a strict 50/50 split. Instead the court will look at what’s “just and right” under the circumstances. This is often referred to as “equitable distribution”meaning the court will divide in a way that’s fair under the circumstances. This may include factors like each spouse’s earning capacity, the length of the marriage and each spouse’s health. If there’s a significant difference in income or one spouse has substantial ongoing medical expenses, the court may award them a larger share of the community estate.

Question #2: How Do I Distinguish Between Community Property vs. Separate Property in a Texas Divorce?

Community Property vs. Separate Property: Defining the Community Estate

Community property is generally anything acquired by either spouse during the marriage including wages, salaries and benefits like pension plans. Real property purchased with marital funds and bank accounts funded from either spouse’s earnings typically fall under community property. These assets become part of the “community estate.”

On the other hand separate property belongs to one spouse and is not divisible in the divorce. Identifying and valuing a spouse’s separate property during the divorce process is critical to ensure an equitable division. Common examples include:

- Gifts or inheritances received by one spouse only.

- Compensation for pain and suffering in a personal injury settlement.

- Property owned before marriage (assuming it wasn’t commingled with marital funds).

Proving Ownership and Characterization

Spouses often disagree on whether a certain asset is community or separate property. This is where characterization (the process of determining the nature of the property) becomes important.If you claim an asset as your separate property, you generally must prove that you acquired it before marriage or through gift, inheritance, or other qualifying means.

Documentation is key. Keep track of deeds, bank statements, receipts or gift letters to support your claim that certain items are not part of the community estate. If you can’t prove something is separate, the law presumes it is community property.

Related Guide: Tracing Separate Property in Texas Divorce

Question #3: How Does the Process of Dividing Property Work in a Texas Divorce?

Dividing Marital Assets & Community Debt

When you file for divorce, you or your attorney will inventory all assets and liabilities. This includes everything from real estate to credit card debt. Once the judge (or you and your spouse if settling outside of court) determines which property is community and which is separate, it’s time to allocate them.

Community debt—like joint car loans or mortgages—can also be split, either by assigning responsibility to one spouse or by requiring both spouses to continue sharing payments. The court’s final order, known as the divorce decree, will formalize how these debts are handled along with property division and other terms.

Child Custody, Child Support and Other Factors

Property division, and what you may be entitled to, can also be influenced by child custody arrangements. For example if one spouse is awarded primary custody, keeping the marital home might be more practical for the children. Child custody does not legally dictate how community property is divided but can play a role in negotiations and settlement discussions. Child support obligations can also come into play when negotiating how to divide the marital estate so both children and spouses are taken care of after the divorce.

Question #4: What Factors Impact the Right Division (Division of Community Property)?

Length of Marriage, Liabilities and Non-Economic Factors

Texas courts want a “just and right” division of community property and that often means looking at:

- Length of the marriage: In a long term marriage especially where one spouse was a stay-at-home parent, courts might award more assets to the financially dependent spouse.

- Earning capacity: If one spouse earns significantly more the court might award the lower earning spouse a larger share of the marital estate.

- Liabilities: Large debts or an uneven distribution of debt can impact how assets are divided.

- Health, age and contributions to the household: Physical or mental health challenges, older age or a spouse’s substantial non-financial contributions (e.g. raising children, managing the home) may all affect the split of community assets.

Personal Injury, Real Estate and Other Special Cases

Personal injury awards can be complicated. If the award compensates for pain and suffering it’s generally considered the spouse’s separate property. However any portion of the award compensating for lost wages during the marriage may be community property.

Real estate often requires special consideration. If you have farm land, rental homes, multiple properties, or international properties, an appraisal is crucial to determine fair market value. Dividing these assets may involve selling them and splitting the proceeds or awarding one spouse the property and the other spouse an offset of equal value from elsewhere in the marital estate.

Question #5: How Are Complex Assets Handled, Like Real Estate and Retirement Accounts?

Retirement Benefits and Qualified Domestic Relations Orders (QDRO)

Retirement benefits– 401(k)s, IRAs and pensions– are often a large part of the marital estate. In Texas, the court divides these accounts in a divorce if the spouses accumulated the funds during the marriage. To split certain employer-sponsored retirement accounts without early withdrawal penalties, attorneys often use a Qualified Domestic Relations Order (QDRO). The QDRO instructs the plan administrator on how to divide the funds between the spouses.

Community Funds, Bank Accounts and High-Value Assets

Bank accounts, stocks and brokerage accounts opened or funded during the marriage are usually community property. If you have large amounts of money involved or own a small business or partnership interests you may need to hire appraisers, forensic accountants and tax professionals to ensure fair valuation. These specialists can uncover hidden assets, trace separate funds and guide you on structuring complex asset divisions.

Question #6: Why Should I Work with a Divorce Attorney or Law Firm?

Protecting Your Interests Through Professional Guidance

Texas divorce law is complicated and going it alone can have unintended consequences–especially if the other spouse is represented by an attorney. An experienced divorce attorney can help you:

- Draft the paperwork.

- Negotiate settlements.

- Protect your claim to separate property.

- Ensure retirement accounts are divided fairly via QDROs.

The attorney-client relationship provides confidentiality and personalized advice so you can make informed decisions at every stage of the divorce process.

Local Expertise in Dallas and Fort Worth

If you’re in the Dallas–Fort Worth area, hiring a local law firm can be particularly beneficial. Local attorneys know the ropes of Texas courts and the preferences of local judges. High asset or high conflict divorces especially require attorneys who can handle complex financial analysis and negotiations. Finding a reputable law firm with a track record in family law ensures your case is handled with care and expertise.

Question #7: How Do Spouses Prepare for the Property Division Process?

Preparation is key whether you’re looking at a simple division of a few bank accounts or a complex divorce involving multiple properties and business interests. Here’s how to get started:

- Gather Documentation: Collect deeds, titles, bank and credit card statements, retirement account summaries, loan records and any proof of separate property (e.g. gift letters or inherited asset documents)

- Set Your Financial Goals: Decide what assets are most important to you–this could be retirement security, keeping the marital home or protecting family heirlooms.

- Talk to Your Divorce Lawyer: Discuss your financial objectives, liabilities and negotiation strategies. If you want to keep a shared home or a business, talk to your attorney about how that will affect the rest of the property division.

- Think Long-Term: Consider the long term implications of any settlement. For example if you keep the house you’ll also be taking on the mortgage debt and maintenance costs.

By planning ahead and approaching property division with a strategy you’ll be in a better position to reach a settlement that supports your financial well-being after your divorce.

Frequently Asked Questions

FAQs: Community & Separate Property

How does Texas law define community property?

Texas law assumes all assets and income earned during marriage are owned by both spouses and are community property. Some exceptions—like gifts or inheritances—remain separate if kept separate from marital funds.

Can separate property become community property over time?

Separate property can become community property if it gets mixed with marital assets. For example, putting an inheritance into a joint bank account can muddy up ownership lines, so keep records and separate accounts to make sure it remains separate property.

How do I protect my separate property in a Texas divorce?

You can protect your separate property by keeping thorough documentation that proves it was acquired before marriage or through inheritance or gift. Don’t mix these assets with joint accounts or funds and keep records like deeds, bank statements or gift letters to avoid disputes about ownership.

What happens if one spouse hides assets during a divorce in Texas?

Hiding assets is illegal and can get you in big trouble, including contempt of court or sanctions against the spouse who committed the fraud. If you think assets are being hidden, hiring a forensic accountant can help find and document all property before the divorce is final.

Do prenuptial agreements override community property laws in Texas?

Yes. A valid prenuptial agreement can override standard community property rules by defining how assets and debts will be classified or divided. But the agreement must meet legal standards—like being signed voluntarily and full disclosure of assets—to be enforceable.

FAQs: Real Estate & the Marital Home

How is the marital home handled in a Texas divorce?

If one spouse wants to keep the house, they might offer a buyout or refinance the mortgage to get the other spouse off the hook. In other cases, the judge can order the home to be sold and the proceeds divided if that’s the fairest way to settle the property division or pay off marital debts.

Can I buy a house while separated in Texas?

In Texas, community property includes all assets acquired during the marriage, regardless of whose name is on the title. So even if you buy a house while separated, it’s likely to be community property and subject to division. See our guide about buying a house while separated.

FAQs: Unique Asset Division

Are personal injury settlements divided in a divorce?

Personal injury settlements for pain and suffering are usually separate property. But any damages for lost wages during the marriage may be community property, so review the settlement carefully.

What happens to retirement accounts in a divorce?

Retirement accounts earned during the marriage are usually community property and can be split according to a Qualified Domestic Relations Order (QDRO). This court-approved document tells the plan administrator how to divide the funds without triggering early withdrawal penalties or excessive tax consequences.

Are business interests considered community property in Texas?

Business interests created or improved during the marriage may be community property. Accurate valuation usually requires professional appraisals or forensic accounting to ensure each spouse gets a fair share of the business or offset in other marital assets.

FAQs: Fault & Spousal Maintenance

Does fault (adultery or abuse) affect property division in Texas?

Courts generally aim for an equal split but fault (adultery or abuse) can be considered. If one spouse’s fault significantly contributed to the breakdown or harmed the marital estate, the judge may allocate more of the community property to the other spouse.

Who decides if spousal maintenance is awarded in Texas?

A Texas family court judge has the final say on spousal maintenance. They consider factors like the length of the marriage, each spouse’s financial situation and any history of family violence before deciding if maintenance is awarded.

FAQs: Process & Timeline

Do we have to go to court to settle property division in Texas?

No. Many couples reach agreements through negotiation, mediation or collaborative divorce. If those don’t work, then the court will resolve the division of assets and debts by issuing a final order.

How long does property division take in a Texas divorce?

It depends on the complexity of the assets and the parties’ willingness to negotiate. A simple divorce can be final in a few months, while a complex or contested case can take over a year.

Can you divorce without splitting assets?

A status-only divorce lets couples legally end their marriage while leaving property division for later. However, courts rarely grant it. Both spouses must agree, or extraordinary circumstances must exist.

FAQs: Legal Representation

Do I need a divorce lawyer?

While not mandatory, having an experienced divorce lawyer can protect your interests. Attorneys ensure fair property division, navigate procedural complexities like QDROs and prevent surprises that may surface after the divorce is final.

Key Points

- Property Division: Texas is a community property state but courts aim for equitable—not equal—division.

- Assets: Knowing the difference between community and separate property is key.

- Process: Dividing property involves not only assets but also debts and is affected by other divorce issues like child custody.

- Factors: Marriage duration, earning capacity and non-economic contributions matter.

- Complex Assets: Special assets like retirement accounts and real estate require specialized handling through QDROs.

- Professional Help: A divorce attorney can provide local knowledge and strategic guidance.

- Be Prepared: Documentation and communication with your attorney will help protect you.

Conclusion

Navigating the division of property in a Texas divorce can be overwhelming, but understanding the basics can ease your mind. Community versus separate property, the Texas Family Code, and proper documentation all significantly determine how the court ultimately splits assets and debts. While courts aim for a fair and equitable distribution, the unique factors in your marriage—like length, earning capacity, and health—can significantly impact the outcome.

Every divorce case is unique, and how property is divided will depend on your circumstances. If you’re preparing for divorce or in the midst of one, having a knowledgeable divorce attorney in your corner is essential. Proper guidance can save you time, money, and emotional stress, while helping ensure you receive a fair division that truly reflects your contributions and needs.

Disclaimer: This article is for educational purposes only. It does not constitute legal advice and does not establish an attorney-client relationship. For advice tailored to your specific situation, please consult a qualified Texas divorce attorney.

Ready to Speak With a Texas Divorce Attorney?

If you’re in the Dallas–Fort Worth area or elsewhere in Texas, our experienced legal team at Warren & Migliaccio, L.L.P. is here to guide you through every step of the divorce process. We pride ourselves on clarity, compassion, and practical advice tailored to your situation.

Call us at (888) 584-9614 or visit wmtxlaw.com to schedule a consultation. Let us help you protect your property rights and build a more secure future as you move forward. Your peace of mind is our top priority.

Source: Divorce Property Division Settlements Are Not Always 50/50 in Texas Family Law – Spofford Law

Source: Divorce Property Division Settlements Are Not Always 50/50 in Texas Family Law – Spofford Law

What Did Penny Learn?

“So Chris, I’m not sure I paid attention to everything, that was a lot more than I was expecting, but I caught the part about separate property and inheritance,” Penny said.

“Good Penny, that sounds like it’s important to you,” I said.

“But I’m not sure if I understood it. I mean the inheritance should be mine alone, not marital property,” she said with some doubt in her voice.

“Yes, that’s true, but it depends on what you did with it. Did you keep it in a separate account or did you deposit it in a joint account?” I asked her.

“Do with it? I haven’t done anything with it yet, I’m still trying to get through probate in New York,” she said.

“Okay, well that’s good in this instance, that means it will stay separate property in your name only and won’t be part of the division of marital assets, “ I said. “But depending on how much you’re inheriting, and many other factors we’ll have to get into, there’s a chance it could impact how the rest of your assets are divided. Did you catch the part about the court wanting a fair and equitable distribution?”

“I did catch that Chris. I also caught the phrase just and right. It all makes sense. So what else do we need to go over?” she asked.

Next Steps in Penny’s Divorce Process

“There’s a lot,” I said. “First, I’ll need to document all your assets and debts. I’ll need to know how long you were married, how much each of you contributed to the marital estate, what your current earning capacity is…”

“Chris, this is too much at once,” she interrupted. “I’ve learned plenty already. Can we talk about all this next time we meet? I’ve had enough for today. I’m just glad I found a divorce attorney I can trust.”

“Thank you Penny. Yes, we can leave it there for now, but not for too long. The more prepared we are, the better. I promise, I’ll make all this as easy for you as possible but you will need to do your part so I can do mine even better. We’re a team now.”

“Yes sir, we’re a team. Thanks Chris. Let me digest all this over the weekend and I’ll be ready to get to work documenting our assets on Monday,” she told me as we wrapped up our meeting.

I was pleased that Penny learned that there’s a lot more to property division in Texas than she initially thought.

Schedule a Division of Property in Divorce in Texas Consultation With Our Firm

Divorce can be stressful and challenging, but you do not have to face it alone. Our team of experienced Dallas family attorneys is ready to provide you with the guidance, support, and legal advocacy you need during these challenging times.

Whether you are seeking to learn about property division here in Texas or navigating any divorce related matters, our experienced divorce attorneys are here to help you every step of the way. We welcome you to schedule a consultation to discuss your situation and case objectives. We can answer your legal questions and discuss how we can help you move forward. Call our law office at (888) 584-9614 or contact us online to schedule your consultation.