A well-drafted estate plan gives you peace of mind, letting you provide for your loved ones after you’re gone. One crucial tool in many estate plans is a revocable living trust, which many people use to avoid probate court’s time and expense.

But can a living trust be contested in Texas? In short, yes. Just like wills, interested parties can challenge a trust in Texas, usually during trust administration. If you’re creating a trust or named as a beneficiary, understanding the grounds for contesting a trust is crucial. Knowing how to help prevent a trust contest can protect your wishes and legacy.

Why Might Someone Contest a Trust?

While anyone can file a lawsuit over almost anything, that doesn’t mean they’ll win. To successfully contest a living trust in Texas, valid legal grounds are needed. Simply being unhappy with the terms isn’t enough.

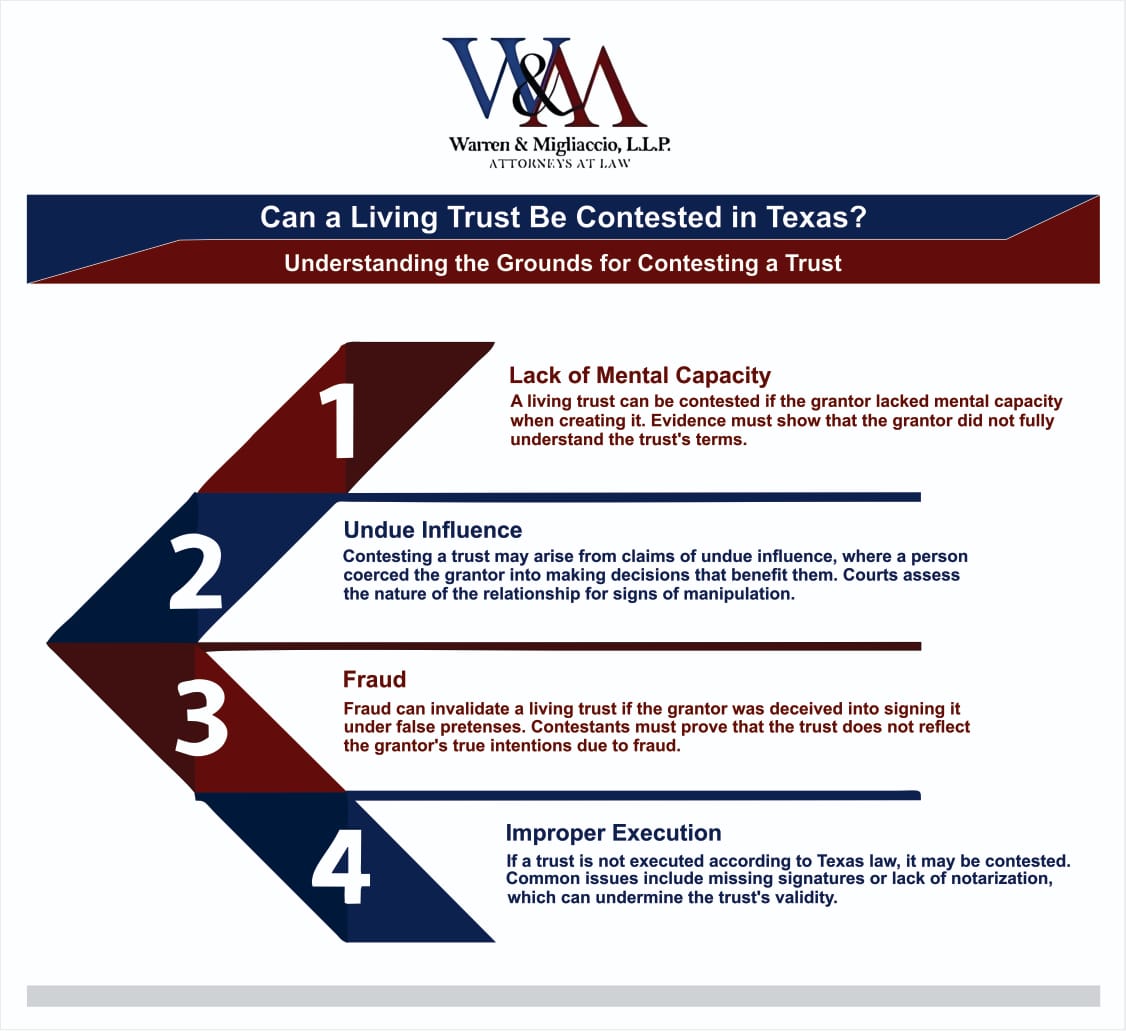

Common reasons for contesting a trust include a lack of testamentary capacity, undue influence, fraud, and improper execution. These factors can call into question the validity of the trust and the intentions of the trust grantor. Let’s take a closer look at each of these:

1. Lack of Mental Capacity (Testamentary Capacity)

Texas law states that the person creating a trust (the grantor) must be of sound mind when establishing the trust. They must understand their actions and their effect, meaning they understand the trust’s property, beneficiaries, and terms.

If someone believes the grantor wasn’t mentally sound when they created the trust, they may contest it. This is especially relevant in cases where a medical condition like dementia impacted the grantor’s decision-making. For example, if a close relative told the grantor they were signing a document needed for a vehicle sale, but they were really signing the trust document, that would be considered a lack of mental capacity.

Because this ground focuses on the grantor’s state of mind when they signed the trust, establishing capacity is important. Having the grantor undergo a mental competency evaluation at the time of signing can deter challenges based on capacity in the future by proving they were of sound mind and help avoid issues later on.

2. Undue Influence

Undue influence occurs when someone pressures or coerces the grantor into creating or changing a trust to benefit them. This pressure essentially removes the grantor’s free will, leaving them unable to make decisions in their own best interest.

This pressure often involves a caregiver or family member taking advantage of their position. Consider a scenario where an aging parent relies on a caregiver. The caregiver uses their influence to persuade the parent to name them as a primary beneficiary, potentially cutting out other family members.

Courts analyze undue influence cases to see if this occurred by looking at the relationship between the parties involved to determine if the grantor was unduly influenced.

3. Fraud

Trust contests based on fraud involve tricking the grantor into signing the trust document. The grantor might believe they’re signing something else entirely, meaning they didn’t know they were signing a trust or that it included specific terms.

In Texas, evidence of forged signatures or falsified documents related to the trust can lead to a successful contest. Parties include individuals named beneficiaries who suspect foul play and seek to prove that the trust document doesn’t reflect the genuine wishes of the grantor.

4. Improper Execution (Failure to Comply with Legal Requirements)

Texas law, specifically the Texas Trust Code, lays out how a trust must be created and executed to be valid. Improper execution might involve missing signatures from required parties, like the grantor or witnesses, failure to properly notarize the document, or issues with the trust’s wording that make it unclear or unenforceable.

Any of these issues might invalidate the trust, leading to legal challenges and potential disputes among beneficiaries or interested parties. It’s essential to understand that even small errors in the trust’s execution can have significant consequences.

How Can You Protect Your Trust From Being Contested?

While no measure is foolproof, you can do things to strengthen a living trust and minimize the likelihood of a successful challenge.

1. Hire an Experienced Texas Trust Attorney

Perhaps the most critical step in creating a strong living trust involves filing with an experienced trust attorney in Texas. Having a trust attorney guide you is invaluable, even if it seems simple. A skilled attorney helps you consider potential issues and ensures your trust complies with all legal requirements, including proper execution and including specific clauses.

A properly-drafted trust prepared by a legal professional carries a higher degree of validity in court. Cases emphasize the importance of enlisting the right legal counsel when drafting these sensitive documents to reduce the risk of challenges later.

2. Create a “No-Contest” Clause

A “no-contest” clause, sometimes called an “in terrorem” clause, can deter challenges. This clause states that any beneficiary who contests the trust and loses forfeits their inheritance. Texas law recognizes these clauses, but they aren’t always ironclad. Courts can choose not to enforce them under certain circumstances.

3. Communicate With Your Beneficiaries

Transparency and open communication can reduce misunderstandings and minimize the chance of someone challenging the trust later. This doesn’t mean you must share every detail with your beneficiaries. However, having open conversations about the reasons behind your decisions helps. Providing context for how you’re distributing your assets can potentially mitigate disputes later on.

4. Keep Your Trust Updated

Life is always changing. You may experience marriage, divorce, having children, the death of a beneficiary, or acquiring significant assets. Your trust must reflect your current circumstances, so regularly reviewing and updating it with an experienced estate planning attorney ensures this and keeps your estate plan in line with your wishes.

What if You Are a Beneficiary?

Navigating the intricacies of a trust and potential contest situations can be complex, and specialized resources often provide valuable support.

Online platforms like SmartAdvisorMatch can connect individuals with financial advisors who specialize in estate planning, potentially providing guidance for beneficiaries during such challenges. Seeking professional legal advice, as necessary, remains paramount for those embroiled in such legal disputes.

Is It Difficult to Contest a Trust?

The likelihood of succeeding when contesting a trust, such as a revocable living trust, often hinges on a bunch of factors, which can sometimes make or break a case. You will need to understand concepts such as; proper legal grounds, strong supporting evidence, state laws (which change constantly), how quickly someone files, the expertise of your lawyer, court proceedings, alternative dispute methods like mediation (yes, sometimes families find middle ground), costs, risks, and overall benefits. All these factors play a huge role in the final outcome of challenging a trust.

Don’t forget to always factor in the emotional toll these contests can take, making the entire situation stressful and expensive if both sides lawyer up. Seeking experienced legal counsel early on can make a big difference in increasing the chances of a more favorable result. This makes consulting legal professionals specializing in trusts crucial in making sure you fully understand if a trust contest makes sense in the first place. A trust attorney can assess the strength of your case, advise you on the potential outcomes, and help you weigh the costs and benefits of pursuing a trust contest.

FAQs About Can a Living Trust be Contested In Texas

What are the Limitations of a Living Trust?

Though a powerful tool for estate planning, living trusts have limitations. They primarily deal with probate avoidance and don’t replace the need for other estate planning documents like a will, healthcare power of attorney, or durable financial power of attorney. It’s important to consult with an estate planning attorney to address all aspects of your estate, including any limitations, to ensure comprehensive planning.

Can a Beneficiary Override a Trustee?

Typically, a beneficiary cannot simply override a trustee. A trustee holds a fiduciary duty to the trust, meaning they have a legal obligation to act in the best interests of the beneficiaries according to the terms of the trust. While a beneficiary might disagree with the trustee’s actions, challenging them often requires proving mismanagement, breach of fiduciary duty, or other legal violations.

What is the No-Contest Clause in a Trust?

A no-contest clause is a provision included in a trust to discourage beneficiaries from contesting the trust. This clause states that a beneficiary will lose their inheritance if they challenge the trust’s validity and lose. While not always enforceable, a well-drafted no-contest clause, created with the guidance of an experienced estate planning attorney, can act as a deterrent and encourage beneficiaries to respect the grantor’s final wishes. This helps prevent costly and time-consuming litigation and ensures a smoother transfer of assets.

Conclusion

While the question “Can a living trust be contested?” is common in Texas, the real goal is to make the answer a resounding “no.” By following these guidelines and working closely with experienced Texas estate planning attorneys, you can feel confident that your wishes will be honored and reduce the chance of conflict among your loved ones. Our attorneys have the expertise to walk you through the estate planning process, making sure your wishes are protected and your goals are met. Schedule a consultation and let us explore the best approach for your one-of-a-kind circumstances. Call us at (888) 584-9614 or contact us online to get started.