As a local bankruptcy lawyer here in Texas, clients often call me with questions about the Chapter 7 filing process. But sometimes, they call me eager to share their own ideas as well. Pete was one of them. “Hi Chris,” Pete began, excited. “I know we might file for bankruptcy next month if … [Read more...]

10 Cities That Have Declared Bankruptcy: Lessons Learned and Strategies for Recovery

Bankruptcy can be a daunting experience, not only for individuals but also for cities and municipalities. When a city declares bankruptcy, it often signals a deeper systemic issue involving financial mismanagement, economic downturns, or both. In this blog, we will explore ten notable cities that … [Read more...]

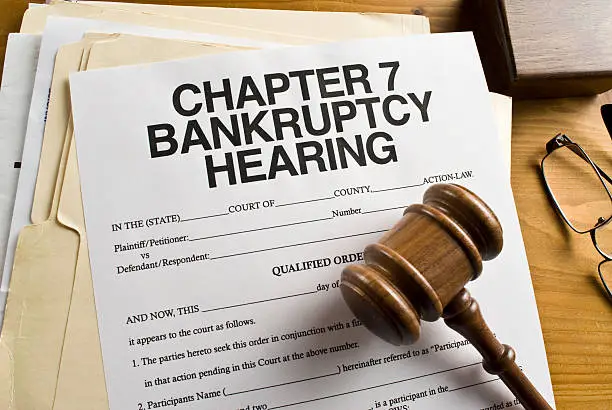

Chapter 7 Bankruptcy Dismissed: Reasons, Consequences, and Alternatives

Having your Chapter 7 bankruptcy dismissed can be unsettling, especially when you're already dealing with financial strain. Many individuals considering Chapter 7 bankruptcy in Texas wonder about the potential consequences and their next steps. Understanding why it was dismissed and the implications … [Read more...]

Protecting Disability Benefits in Chapter 7 Bankruptcy: A Texas Guide

Have you ever found yourself in the midst of a financial storm, hoping and praying for a life raft? Yes, we’re talking about the perfect storm–bankruptcy. Going through a bankruptcy might feel like you’re stranded in open seas amidst a never-ending storm that threatens to put you—and all your … [Read more...]

Separated and Husband Filed Chapter 7: What’s Next?

As an attorney specializing in both family law and bankruptcy, I often encounter cases where financial issues intersect with marital problems. Elise had already let me know she was separated from her husband and might need representation if they were to decide to formally get divorced. Then an even … [Read more...]

Do I Have to Go to Court for Chapter 7? Key Insights

Sarah let out a frustrated sigh as she read the email. "Well, it's official — my 341 meeting with the bankruptcy trustee is scheduled for next week." "Oh man, do you have to actually go to the courthouse for that?" Emily asked with a concerned look. Sarah shook her head. "Thankfully, no. Since … [Read more...]

How Bankruptcy Stops Creditors: A Guide to Automatic Stay

Dealing with aggressive creditors can feel overwhelming, especially if you're facing mounting debt. You might be considering bankruptcy as a way out, but how exactly does it provide relief from relentless collection efforts? This is where understanding how bankruptcy stops creditors can provide some … [Read more...]

Can I Get a HELOC After Chapter 7 Discharge?

As a bankruptcy attorney here in Texas, it’s common for my clients to reach out to me soon after the dust has settled from their Chapter 7 bankruptcy cases. One afternoon, I received a call from Leon, a client I represented in his Chapter 7 bankruptcy case just six months earlier. “Hey, Chris,” … [Read more...]

Chapter 7 Bankruptcy & Unemployment Overpayment in Texas

Navigating Chapter 7 can be challenging, especially with debts from unemployment insurance overpayments. I recently helped my client Ron through this situation. Ron called me with his problem: “Chris, I need your help. I’ve been overpaid on my unemployment insurance, and now I owe a significant … [Read more...]

What is the Income Cut Off for Chapter 7

Overwhelmed with debts? Financial stress can get extremely challenging. But there is a legal process to save you from all the struggle! Filing for Chapter 7 bankruptcy is one of the most common options to wipe off all your unsecured debts, including your personal debt, medical expenses, and … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 13

- Next Page »