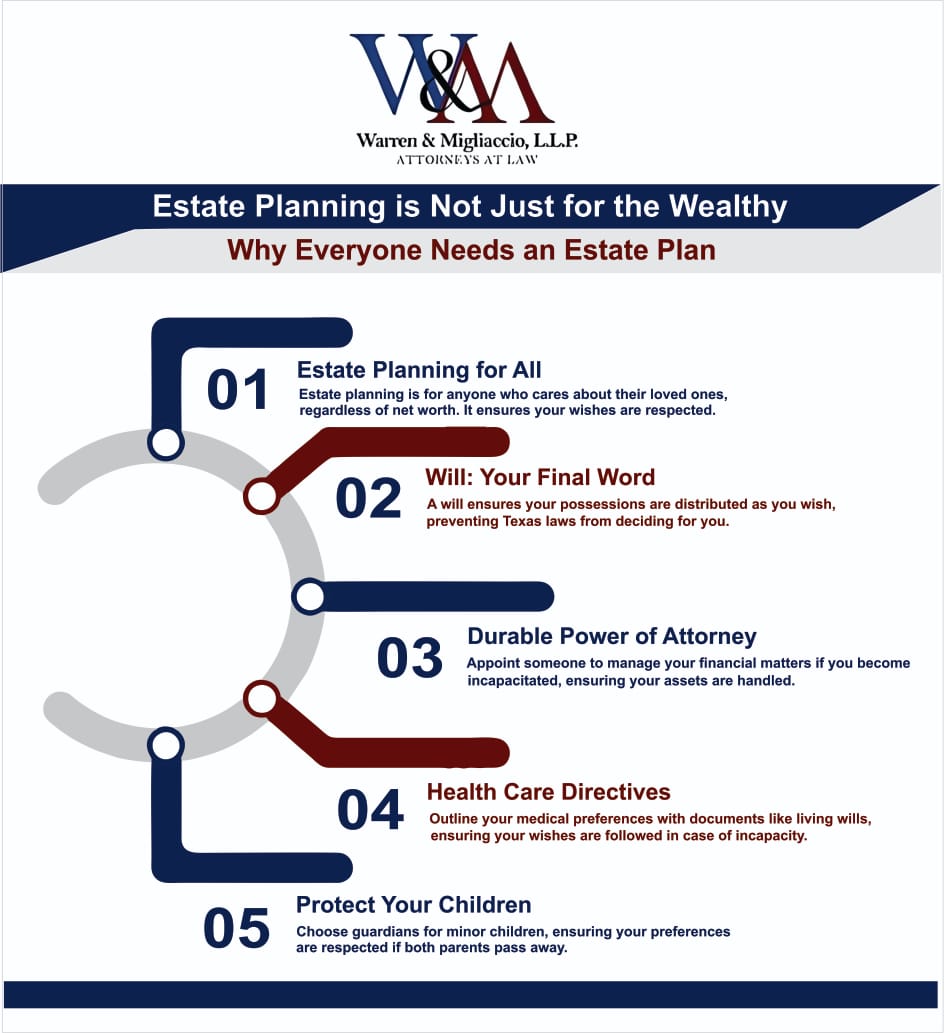

You might assume estate planning is only for the wealthy. Estate planning involves not just drafting a will, but also preparing for unforeseen circumstances, ensuring that medical and financial decisions are honored, and facilitating a seamless transfer of assets after death. However, estate planning is for anyone who wants to protect their loved ones and personal assets. It’s a common misconception that you only need an estate plan if you’re a millionaire.

Why Estate Planning Matters, Regardless of Your Wealth

Estate planning makes sure your wishes are honored. Estate plans are beneficial for individuals of all income levels, ensuring that personal wishes and health care directives are respected, and providing guidance for asset distribution and guardianship for dependents. It’s not about how much money you have; it’s about deciding who gets what and making things simpler for your family members.

According to Caring.com, about two-thirds of Americans do not have estate planning documents. When there is no plan, it can lead to big problems for the people you leave behind.

Why Estate Planning in Texas Is Not Just for the Wealthy

If you own a home, car, or even a small savings account, you already have an estate. An estate plan lets you decide who will inherit these things so that your wishes are followed. A clear plan also explains how bank accounts, insurance policies, and other financial assets should be handled, which helps avoid arguments between family members. A well-structured estate plan can significantly mitigate the potential for disputes over property and financial matters, thereby reducing family conflicts.

It also gives you the power to decide:

- Who will inherit your real estate and personal assets.

- Who will care for any minor children you may have.

Will

A will is a legal document stating how you want your possessions to be distributed after your death. It also lets you name guardians for children. Writing a will ensures your wishes are carried out as you intended.

If you don’t have a will, state law (specifically the Texas Estates Code) will decide how your belongings are split up among beneficiaries.

Durable Power of Attorney

A durable power of attorney lets you pick someone you trust to manage your financial affairs if you become too ill or injured to handle them yourself.

This is especially helpful if you can’t make financial decisions on your own because of sickness or an accident. As Fidelity points out, a trust can be an important part of a comprehensive estate plan. Meanwhile, the person holding your financial power of attorney can help pay bills and handle other financial needs.

Health Care Documents

Advance directives—such as living wills and medical powers of attorney—explain your preferences for medical care if you become incapacitated.

These papers ensure doctors and loved ones know exactly what you want for medical treatment, including organ donation or life support options. According to Fidelity, a durable power of attorney can also cover healthcare decisions. In addition, naming designated beneficiaries on financial accounts can be another smart planning step.

Benefits of Estate Planning for Everyone

Setting up even a simple estate plan is usually straightforward, though some people think it’s too complicated. The benefits, however, can be huge.

- You gain peace of mind knowing your wishes are clear.

- Your family is less likely to fight over property.

- An experienced estate planning attorney can help you understand how life insurance policies might support your overall plan and navigate complex strategies to ensure a secure legacy.

AmeriEstate provides more details about estate planning’s importance in your broader financial situation. With professional help, you can fulfill your fiduciary duty and make changes whenever needed.

Protect Your Minor Children

Estate planning allows you to name a guardian for minor children if both parents pass away. This prevents the probate court from picking someone you might not have chosen.

If you don’t have a will, the court decides who raises your children without considering your personal wishes.

Avoid Probate Disputes

When inheritances are spelled out clearly, there’s less chance that your family will fight over assets. This can reduce unnecessary stress during an already painful time.

Direct Your Legacy

Estate planning helps you decide where your assets go, letting you make a positive impact on loved ones or even your favorite charity.

From My Experience: Witnessing Relief in Estate Planning

I once assisted a middle-income family who thought they didn’t need estate planning because their assets were modest—a small house, two cars, and some retirement accounts. When the husband died unexpectedly, his wife was left grief-stricken and unprepared to handle financial decisions.

They had no healthcare directive or financial power of attorney in place. This meant she struggled to access accounts and make urgent decisions. Later, she came to set up a proper estate plan for herself. I’ll never forget the relief on her face after finalizing her documents—she finally felt secure about her financial status and could focus on her own healing.

That experience confirmed for me that estate planning helps everyone, not just those with significant assets. It’s truly about protection and peace of mind.

Common Misconceptions About Estate Planning in Texas

Several myths still exist about who actually needs an estate plan in Texas. Here are some common misunderstandings:

“I Don’t Own Enough to Need an Estate Plan in Texas”

This is the biggest myth. Even smaller estates can benefit from a plan, because it prevents family fights over things like personal mementos or heirlooms. A simple will can make a big difference.

Your estate plan can also outline what happens to retirement plans, including IRAs. It’s an essential tool for preparing your financial situation. A living trust might help you transfer property more smoothly by letting you avoid the probate process.

“Estate Planning Is Too Expensive”

Another common misconception is that it costs too much. Fortunately, there are many affordable avenues, such as legal aid, online help, and community workshops.

These resources offer guidance on estate planning documents. You don’t need vast fortunes to plan; you just need to make sure your belongings and beneficiary designations are handled the way you want.

Components of a Texas Estate Plan

A solid estate plan in Texas includes several key documents. You might talk with an experienced estate planning attorney and possibly a financial advisor to create a plan that suits your unique needs.

| Document | Purpose |

|---|---|

| Will | Distributes assets after death, names guardians for minor children, and covers issues linked to family law and property division. |

| Durable Power of Attorney | Gives someone authority over your financial affairs if you become incapacitated. This includes handling bank accounts, insurance policies, and other accounts. |

| Medical Power of Attorney | Appoints someone to make healthcare decisions if you can’t. They help guide doctors on your preferred medical treatment. |

| Directive to Physicians and Family or Surrogates (Living Will) | Lays out your end-of-life care wishes, including whether you want life support and how you feel about organ donation. |

| Declaration of Guardian for Minor Children | Names who will care for your children if you die or become incapacitated. This is vital if you have young children. |

Estate Planning Costs in Texas

Hiring a qualified attorney helps you draft legally binding documents that protect everyone involved. An attorney may also recommend creating a trust if it will help you meet the specific goals of your beneficiaries.

According to CNBC, estate planning doesn’t have to break the bank. If you’re worried about costs, check out CNBC’s advice on affordable estate planning. Having a valid will allows you to avoid probate, while having no will sends your estate into probate court. Avoiding probate can significantly reduce the legal fees associated with the process, even for smaller estates.

|

Estate Planning Document |

Estimated Cost

|

|---|---|

|

Simple Will |

$300 – $1,000 |

|

Durable Power of Attorney |

$100 – $500 |

|

Medical Power of Attorney |

$100 – $500 |

|

Living Will |

$100 – $500 |

|

Basic Trust |

$1,000 – $3,000+ |

Prices vary based on how complex your estate is, the attorney’s experience, and your location. A skilled attorney will make sure you have all the common components to avoid letting probate court decide your distribution of your assets if you pass away intestate (without a will). Consult with an estate planning attorney to see if a living trust is right for you and to keep things out of probate.

Estate Planning and Digital Assets in Texas

In today’s world, your online presence is part of your life. Texas estate planning can cover your digital assets—like social media, email accounts, and online banking. A thorough plan helps clarify who will manage these digital items, preventing conflicts.

Managing Your Digital Legacy

Most online services have specific rules about what happens to accounts after death. To protect your digital legacy, your plan should outline:

- Who can access your digital accounts.

- Any financial products you store online (like investments or retirement details).

- Whether you want a special “digital executor.”

This way, your online property is handled smoothly. Consider talking to a firm with trust administration experience to make sure everything is covered.

Key Statistics on Estate Planning in America

Understanding the numbers can help you see why estate planning is important:

- A 2021 Gallup poll found that only 46% of American adults have a will. The number is even lower among those with smaller incomes. [https://news.gallup.com/poll/351500/how-many-americans-have-will.aspx]

- The National Association of Estate Planners & Councils reports 67% of Americans do not have an updated estate plan, even though most say it’s important. [https://www.naepc.org/]

- Care.com found that 78% of millennials and 64% of Generation X do not have a will.

- The American Bar Association states that probate can cost 3-8% of an estate’s total value, but good planning reduces these costs. [https://www.americanbar.org/groups/real_property_trust_estate/]

- Research from BMO Wealth Management shows around 40% of family businesses fail to pass to the second generation due to poor succession planning. [https://www.bmo.com/main/wealth-management/]

- The National Academy of Elder Law Attorneys says 55% of Americans die without a will, which leaves state laws in charge of asset distribution. [https://www.naela.org/]

Case Study: The Unexpected Consequences of No Estate Plan

A married couple in Texas had a blended family but never made an estate plan, assuming everything would go to the surviving spouse. When one partner passed away:

This caused confusion and tension, showing how important an estate plan is for blended families.

By Texas law, half of the deceased partner’s assets went to the surviving spouse, but the rest went to the children (including children from a previous marriage).

Real-World Estate Planning Success: Small Business Owner Protection

A small-business owner in Dallas thought his modest company did not require formal estate planning. With yearly revenues under $500,000 and only three employees, he believed a simple will was enough. After meeting with our team:

- We checked his situation and realized that if he died, the business might be sold off to pay taxes and bills, leaving nothing for his children who worked there.

- We set up a detailed estate plan that included business succession strategies, making sure the business could continue.

According to the Small Business Administration, fewer than 30% of family businesses survive to the second generation due to poor planning. https://www.sba.gov/sites/default/files/advocacy/rs343tot.pdf]

Our client was greatly relieved to know his hard work and his family’s main source of income were protected. This story shows how proper planning can benefit anyone, not just wealthy individuals.

Estate Planning Resources

You can find many online resources to help you stay organized financially:

- Online calculators can guide you in managing financial matters.

- Online banking services often provide learning centers for topics like retirement accounts or dealing with lost credit cards.

These tools can simplify your financial situation and help you learn more about estate planning at your own pace.

FAQs Regarding: The Basics of Estate Planning

Is estate planning only for the wealthy?

Who benefits most from estate planning?

Why do people not do estate planning?

When should I start estate planning?

How often should I update my estate plan?

FAQs Regarding: Wills, Trusts, & Probate

Can you write your own will in Texas?

What is the difference between a will and a trust in Texas, and is a will enough on its own?

How does the probate process work in Texas?

Who should I appoint as executor of my will in Texas?

FAQs Regarding: Costs & Taxes

How can I reduce estate taxes in Texas?

FAQs Regarding: Wealth vs. Estate Planning

What is the difference between wealth planning and estate planning?

1. Estate planning focuses on what happens to your assets after death or if you can’t manage them anymore.

2. Wealth planning covers broader strategies like investing, taxes, and insurance during your life.

Both are important for protecting your family’s future and having greater control over your legacy.

Conclusion

Estate planning is not just for the wealthy. Whether you have a small home or many financial products, a clear plan gives you peace of mind and greater control over your legacy. It’s especially important for anyone with minor children.

Remember, estate planning isn’t only for wealthy individuals with vast fortunes. It’s a smart step for anyone who wants to make sure loved ones are cared for according to their wishes.

Our experienced estate planning attorneys can create a plan that meets your unique needs and guide you through the legal process. Call us at (888) 584-9614 or contact us online to begin planning your estate today.