When a credit card company sues you for unpaid credit card debt they’ve decided to take legal action to collect the debt you owe. This type of legal action is called a debt collection lawsuit and ignoring it can have severe consequences. This article will walk you through what happens when a credit card company sues you next and what to do right now to protect yourself. Understanding how unpaid credit card debt, late fees and court costs add up is key at this point.

Bottom Line

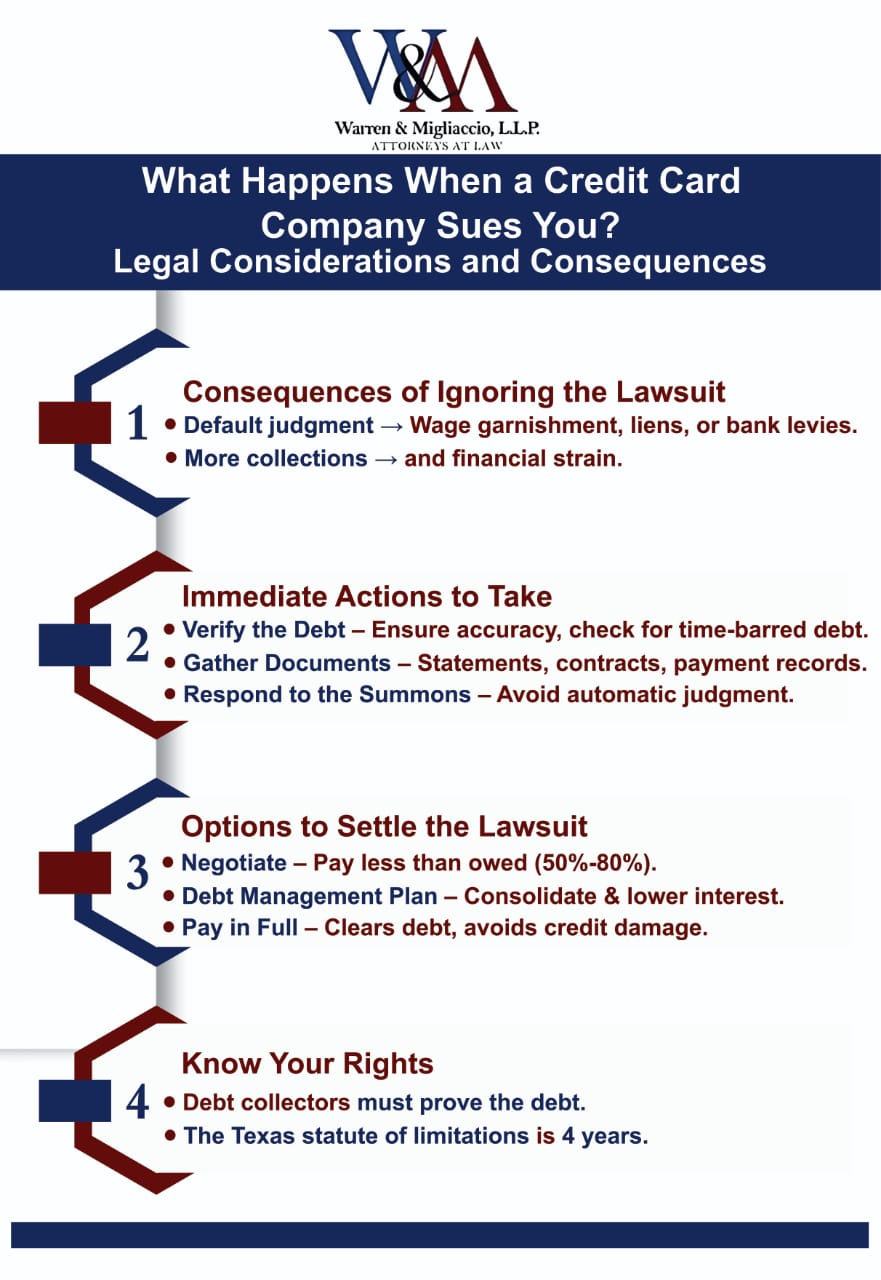

Understand the process; respond to the summons to avoid a default judgment that will make your financial situation worse and lead to more calls from a debt collection agency from missed payments.

Verify the debt; check for time-barred debt and gather documents as your first step to defend against a credit card lawsuit.

Explore settlement options; negotiate a settlement, payment plan or work with credit counselors to manage your credit card bills and stop aggressive collections. Sometimes bankruptcy is a last resort.

Understanding the Lawsuit Process

In Texas, a lawsuit starts with a creditor serving you with a summons and complaint. Typically a credit card issuer or debt buyer will do this if your credit card account remains unpaid. This document means the creditor is taking legal action for unpaid debt and is a major stage in debt collection. Creditors usually file a lawsuit after several attempts to collect the debt, often 90 to 180 days after missed credit card payments.

Receiving a summons is a wake up call. It’s the creditor’s final warning that legal consequences are looming if the debt is not addressed. Since credit card debt is unsecured debt the creditor will use legal measures to collect unpaid debt. Ignoring this summons can result in a default judgment against you and the creditor can pursue collections more aggressively. This can include bank levies or liens that will impact your financial situation.

Although the process is scary responding to the summons will deter creditors from being aggressive. File a response within the timeframe given, address the creditor’s claims and present your defenses. Resources from the Consumer Financial Protection Bureau can be helpful in understanding your rights. Knowing what to expect and how to respond is key to navigating this situation. Understanding the process allows you to take action to defend yourself and explore resolutions. Now let’s get to the immediate actions to take when faced with a credit card lawsuit.

Immediate Actions to Take When a Credit Card Company Sues You

When you receive a summons act fast. If the debt is unpaid it may be sold to collection agencies which can then pursue recovery through lawsuits. The response time can be as short as 14 days, depending on the court handling your case, and if you don’t respond a default judgment can be entered and collectors can enforce payment more aggressively. This is often your first step in dealing with the lawsuit. Acting fast prevents the court from deciding without you.

Start by verifying the debt and gathering all documentation. These steps lay the foundation for your defense and help you navigate the process.

Verify the Debt

Verifying the debt serves as your first line of defense, ensuring its accuracy and that you indeed owe it. The Fair Debt Collection Practices Act protects against abusive practices while supporting legitimate debt collection (https://www.ftc.gov/legal-library/browse/statutes/fair-debt-collection-practices-act). Verifying the debt helps you avoid paying for incorrect or time-barred debts.

Knowing your rights under this act allows you to respond to the lawsuit effectively. Verifying the debt helps you gather information to assert defenses and challenge discrepancies.

Gather Documentation

Gather all relevant documentation for a strong defense. Compile credit card statements, contracts, payment records, credit card bills and correspondence with the creditor. These documents support your case and provide evidence of your financial situation and past collection efforts.

A well organized set of documents can impact your court case. It allows you to present a clear and accurate picture of your financial history and bolster your defense.

Options to Settle the Lawsuit

After verifying the debt and gathering your documents explore your options to settle the lawsuit. One option is debt settlement which involves negotiating with creditors to pay reduced amounts instead of lawsuits. Strategies include negotiating settlements, debt management plans or paying the full amount.

Each option has pros and cons and the right choice depends on your financial situation and negotiation ability.

Negotiate a Settlement

Negotiating with the debt collector can be a practical way to manage debt issues. Collectors may be willing to negotiate especially if they don’t think they can collect in full. A settlement usually means a lower payment than you originally owed and prevents further legal action. Settling the debt can bring relief and stop the stress and cost of ongoing legal proceedings. It may also eliminate additional charges like late fees or court costs associated with a prolonged debt collection lawsuit.

Enter a Debt Management Plan

A debt management plan is another option. In this plan you make monthly payments to a credit counseling agency who then pays the creditor. Working with credit counselors to develop a workable plan can help you stay current on your financial obligations. This can consolidate payments and possibly lower interest rates. Credit counseling agencies provide personalized plans to manage debts more effectively, improve financial literacy and budgeting skills.

Working with a credit counselor can simplify payment and prevent further legal action, it’s a good option for many.

Pay the Full Amount

Paying the full amount of the debt is the most simple solution. This eliminates the debt and renders the lawsuit unnecessary. The account will show as paid in full on your credit report with no derogatory mark.

Paying in full helps you avoid potential negative marks from settlements, so you can move forward with a clean slate.

Legal Defenses and Rights

Knowing your legal defenses and rights is key to responding to a credit card lawsuit. Consumers are protected against abusive debt collection practices by various laws. You can challenge a lawsuit based on defenses like the debt being time-barred or not properly served.

If a creditor violates your consumer rights you may have grounds to sue them.

Understand Fair Debt Collection Practices

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from engaging in deceptive conduct, such as intimidating consumers or using false representations. They must provide validation notices detailing the debt amount and creditor information, so consumers are informed about their debts.

These protections ensure fair treatment of consumers and prevent abusive practices.

Challenge the Lawsuit

You can challenge the lawsuit if you have a strong defense against it. For example, some proven defenses that can improve your chances of winning the lawsuit include problems with the debt’s validity and an expired statute of limitations, which in Texas is generally four years under Texas Civil Practice and Remedies Code § 16.004. If the debt collector cannot produce necessary documents, you can request dismissal of the lawsuit and might even countersue.

Verifying the accuracy of the debt details and making sure legal procedures were followed helps you defend against the lawsuit.

Court Preparation

Court preparation means understanding procedures and being ready to present your case. Consumers can dispute the lawsuit and require the debt collector to prove the debt’s validity. Request dismissal if the debt collector can’t provide enough evidence. Seek help if you feel overwhelmed in court.

Hire an Attorney

Hiring an attorney gives you guidance and representation throughout the court process. Legal advice and representation is crucial depending on the case. Referrals from other attorneys can help you find an attorney experienced in debt collection cases.

Consult with several attorneys before hiring to compare experience and fees so you can choose the right one for your case.

Self-Rep Tips

If you self-rep, collect all financial documents and correspondence to support your case in court. Familiarize yourself with court rules and procedures to avoid traps.

Some legal aid organizations offer free representation for low-income defendants and extra support when needed.

Potential Outcomes

The outcome of a credit card lawsuit can impact your financial life. If the creditor wins, they get a judgment against you, or a court order that establishes the money you owe them. Once they have a judgment, they may pursue bank garnishment or property liens. However, generally, they cannot garnish your wages in credit card debt lawsuits.

Debt collection lawsuits have long term effects on your credit score.

Bank Garnishment

If court rules in favor of credit card company, it can result in bank levies or property liens. In some cases, it can freeze bank accounts.

Wage garnishment is not available in Texas unless it’s from out of state judgment or child support.

Settlement

Settling can stop further collection activity and lawsuit by creditor. Settlement agreement resolves the lawsuit.

Rebuild Your Future

After the lawsuit is settled, rebuild your future. Paying in full can improve relationships with creditors and get better credit terms.

Consumers are protected from abusive debt collection, preventing bankruptcy and marriage problems.

Credit Counseling

The credit counseling is working with a certified agency to develop a debt plan and improve your financial health. These agencies offer guidance, support and resources that impact your financial situation.

Debt management plans is structured debt repayment, often lower monthly payments and lower interest rates. Rebuilding credit after debt management is key to financial recovery.

Secured Credit Cards

Using a secured credit card responsibly builds a positive payment history. Regular use and on time payments can improve your credit score over time. Secured credit cards help you establish or rebuild credit, a managed way to improve your credit score over time.

Frequently Asked Questions

Timing and Legal Limits

How long does a creditor have to sue you for credit card debt in Texas?

Creditors have four years from your last payment or debt acknowledgment to file a lawsuit. After that, the debt is time-barred, meaning the lawsuit is no longer legally enforceable. Always verify the timeline for your case.

What is the minimum amount credit card companies will sue for in Texas?

There’s no statewide minimum. But most creditors sue for at least a few thousand dollars. Smaller amounts often aren’t worth the legal fees.

Responding to a Lawsuit

What should I do after receiving a summons for a credit card debt lawsuit in Texas?

Respond immediately to avoid a default judgment. A default judgment lets collectors enforce payment more aggressively. Verify the debt and gather documents right away. This helps you explore your options.

Should I hire an attorney for a credit card debt lawsuit?

An attorney can help, especially if the case is complex or overwhelming. Consider consulting multiple lawyers. Compare their fees, experience, and defense strategies before deciding.

Settlements and Negotiations

Can I negotiate a settlement with the debt collector? What percentage do credit card companies accept?

Yes. Many creditors prefer settlements because lawsuits cost time and money. Common settlement amounts include: About 50.7% of the original debt (per a 2018 study by the American Fair Credit Council). Up to 80% if the debt is still with the original creditor. The final amount depends on your negotiation skills and financial situation.

How do credit card lawsuit settlements affect your credit?

Settling a lawsuit often shows as “settled” rather than “paid in full” on your credit report. This can hurt your score more than paying in full. But settling may help you avoid a judgment and stop collections sooner. That could allow you to rebuild credit faster.

Rights and Protections

What are my rights under the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive or deceptive collection tactics. Debt collectors cannot threaten you or lie about your debt. They must also provide a validation notice with details about the debt and creditor. This ensures you can dispute inaccuracies.

Can you go to jail for credit card debt in Texas?

No. You cannot go to jail for unpaid credit card debt. But ignoring a court summons or violating a court order can lead to legal consequences.

Does Texas law protect my bank account from credit card judgments?

Texas law exempts certain personal property. But a creditor with a valid judgment can still try to levy your bank account or place a lien on assets. Acting fast—by negotiating or seeking legal help—can protect your finances.

Summary

Facing a credit card lawsuit can feel overwhelming, but understanding the process helps you stay in control. Responding to a summons prevents a default judgment. Verifying the debt and gathering documents strengthens your defense. Exploring settlement options—such as negotiating with creditors or working with a credit counselor—can lead to a manageable resolution.

If you’re unsure what to do next, speaking with an attorney can help. At Warren & Migliaccio, we guide Texas residents through credit card lawsuits, protect their rights, and explore the best paths to financial recovery. Call us at (888) 584-9614 or contact us online to discuss your case and see how we can assist you.