Filing for Chapter 7 bankruptcy can be a difficult decision. It’s important to understand the ins and outs of the process and what it means for your financial future. One of those considerations is what is a reaffirmation agreement in a chapter 7 bankruptcy?

In a Chapter 7 bankruptcy, a reaffirmation agreement lets you keep property that would otherwise be sold to pay back your creditors. It’s essentially a binding promise that says, “Even though I’m filing for bankruptcy, I want to continue paying for and keep this asset.” Think of it like hitting the refresh button on a specific debt, such as a credit card or a car note, rather than wiping it away entirely.

Reaffirmation Agreement Basics: Why It Matters

Imagine this: you’re facing Chapter 7 bankruptcy and worried about losing your car or your home. That’s where a reaffirmation agreement comes into play. By reaffirming a specific debt, like a car loan or a mortgage, you tell the court and the lender that you want to keep the asset. You are committed to paying the loan

Understanding Chapter 7

Chapter 7 bankruptcy is designed to give people a fresh financial start by wiping out (or “discharging”) many types of debts. This fresh start sometimes comes at a price. Sometimes, you need to sell certain possessions to repay your creditors, especially if they are secured by collateral. A secured debt, like a car loan or mortgage, uses something you own (the collateral) as a guarantee.

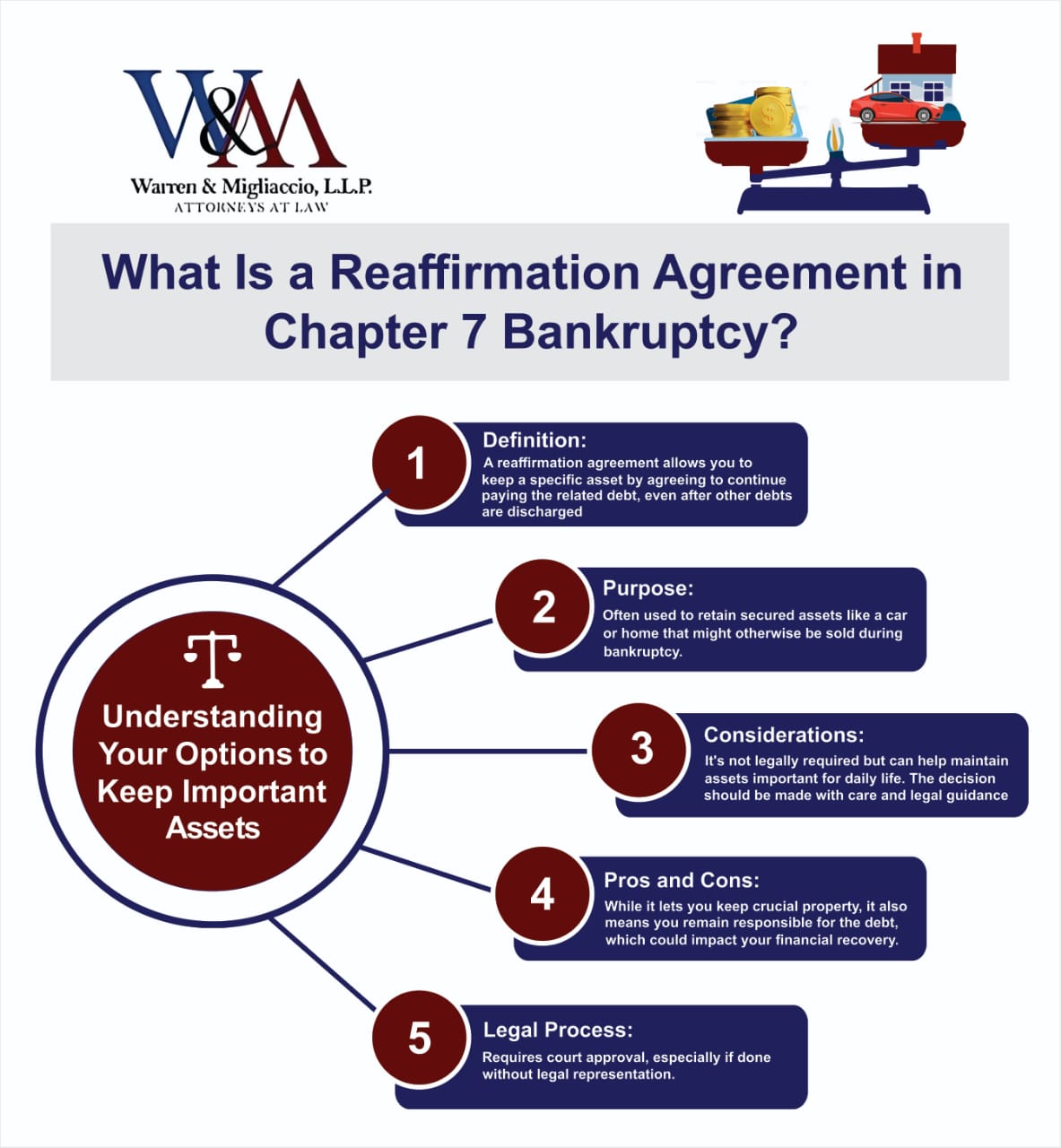

This infographic breaks down the key aspects of reaffirmation agreements in Chapter 7 bankruptcy, helping you understand how to potentially retain important assets while navigating the complexities of the bankruptcy process.

What is a Reaffirmation Agreement?

So, where does the reaffirmation agreement fit into all of this? Here’s the gist:

- It’s a contract between you (the debtor) and your creditor.

- You’re promising to continue paying off a specific debt, even after your other debts are discharged through the Chapter 7 process.

- You get to keep the property connected to that debt.

Reaffirming isn’t a legal requirement for Chapter 7 bankruptcy. It’s often a choice driven by a desire to:

- Keep a treasured asset that might otherwise be liquidated.

- Potentially maintain a positive relationship with a particular lender.

When is Reaffirmation Necessary?

Usually, reaffirmation is used when you want to keep property that’s secured by a loan, such as:

- Your car: If you need your car for work or everyday life and reaffirmation is the only way to keep it, it might make sense.

- Your home: This is a big one, especially if your goal is to keep a roof over your head and avoid foreclosure.

But keep in mind, reaffirmation isn’t always automatic. A lender has the right to accept or reject a reaffirmation agreement, and the bankruptcy court has to give final approval, usually in a hearing.

Benefits and Drawbacks: Weighing Your Options Carefully

Reaffirmation agreements can be complicated and offer both benefits and drawbacks. You shouldn’t take the decision to enter into a reaffirmation agreement lightly, so it’s important to talk to your attorney for proper advice on your specific situation. This table gives an overview of those pros and cons:

| Benefits | Drawbacks |

|---|---|

| Allows you to keep secured property you may lose otherwise | Keeps you in debt for the item even after your other debts are discharged |

| Gives you the potential to rebuild credit by showing lenders you honor commitments | Puts you at risk for wage garnishment or property seizure if you cannot make the reaffirmed debt payments in the future |

| Can sometimes give you some leverage to renegotiate a lower interest rate or better terms with the creditor | Could put you in a difficult financial spot if your circumstances change and you’re no longer able to afford the reaffirmed payments |

Entering Into A Reaffirmation Agreement

To reaffirm a debt in your bankruptcy case, you will need to file certain documents with the court before the court enters your bankruptcy discharge, such as the reaffirmation agreement itself and the Reaffirmation Agreement Cover Sheet. The cover sheet is officially known as Official Bankruptcy Form 27, as found in Reaffirmation Documents from the United States Courts. You must be given certain disclosures under the law.

These disclosures explain your reaffirmation agreement and clarify whether any law requires you to enter into one, along with other important information. If an attorney did not represent you during the negotiation of your reaffirmation agreement, the agreement will only be effective if the court approves it. Generally, it’s not a good idea to sign a reaffirmation agreement without first consulting a qualified bankruptcy attorney. This is essential to make sure it aligns with your overall financial strategy and that you fully grasp its potential implications. Bankruptcy law, like most areas of the legal system, is full of nuances that an experienced attorney can navigate effectively for you.

It’s critical to remember, a reaffirmation agreement is a serious legal document. Signing one can have long-term consequences for your financial future, especially if your financial situation changes unexpectedly.

Reaffirmation Agreements: Are They Enforceable?

Imagine you’re a judge in a bankruptcy court. A reaffirmation agreement lands on your desk. Now, here’s the twist: reaffirmation agreements can be a bit of a legal paradox, as stated in the In re Bennett Ninth Circuit case. Why? Because these contracts are made with the intent to be upheld, even if the debtor later encounters the same financial difficulties that led them to see bankruptcy protection in the first place.

Courts are often hesitant about enforcing these agreements because the whole point of bankruptcy is to provide a fresh financial start. But, they are bound by the law which includes state laws that say contracts must be upheld as decided by In re Bellano, from the Eastern District of Pennsylvania, Bankruptcy Court. Striking a balance between the ‘fresh start’ and the sanctity of contracts becomes a careful dance that judges must perform on a case-by-case basis.

Navigating Reaffirmation in Chapter 7

The big question often arises – should you consider reaffirming a debt in your Chapter 7 bankruptcy? The honest answer is: it depends. This is not a one-size-fits-all scenario, but there are several factors to think through when making this decision, including:

- Do You Absolutely Need to Keep the Property?: If losing the asset would severely impact your life and there’s no other way to keep it, reaffirmation might be an option.

- Assess Long-Term Affordability: Make sure you can realistically afford the payments for the foreseeable future. Bankruptcy might clear existing debt, but what if your income changes or unforeseen expenses arise?

- Property Value vs. Debt: Is the value of the asset significantly less than the debt itself? If so, reaffirmation may not be your most strategic move.

Navigating this path requires careful consideration of your personal circumstances. An experienced bankruptcy attorney can guide you through these nuances and help you understand if reaffirmation aligns with your financial goals. Remember, even in the face of difficult decisions, you don’t have to face it alone. An attorney can help you make well-informed choices that can hopefully pave the way for a brighter and more secure financial future.

FAQs About What Is a Reaffirmation Agreement in a Chapter 7

Why would someone choose to reaffirm a debt?

A debtor may choose to reaffirm a debt for several reasons. The debtor often does this when they want to keep property that serves as collateral for the debt, such as a car or a home. They might feel a moral obligation to repay the debt, even though they are not legally required to, or because a co-signer is also liable for the debt. For some debtors, they may want to reaffirm a secured debt, such as a credit account, to help rebuild their credit score.

What happens after the reaffirmation agreement is signed?

You must file the signed reaffirmation agreement with the court no later than 60 days after the first date set for the meeting of creditors. If an attorney represented you during the process, the reaffirmation agreement becomes effective when filed with the court (except in some limited instances with credit unions). However, if you were not represented, you will need to attend a court hearing for a judge to determine whether to approve your reaffirmation agreement. The bankruptcy court will review the agreement to ensure that it does not impose an undue hardship on the debtor.

Who prepares the reaffirmation agreement?

The creditor usually prepares the reaffirmation agreement, but it can also be prepared by a bankruptcy attorney. Regardless of who prepares it, you should read it thoroughly before you sign it and ask your lawyer any questions about the agreement. For example, before signing, you want to be sure that this is a debt you want to reaffirm as you are not required by any law to do so.3 You also want to make sure you understand what will happen if you don’t make the payments under the agreement or if you fail to make a payment during your bankruptcy case. If the property is exempt personal property, meaning your creditors cannot take it to satisfy your debts, or if the trustee, appointed by the court to administer your bankruptcy case, has abandoned it, meaning the trustee is not seeking to sell it to pay your creditors, you may want to consider redeeming the item rather than reaffirming the debt. To redeem means to make a one-time payment to the creditor that is equal to the value of the collateral. You can also talk to your lawyer to see if your state requires any special reaffirmation forms to be completed in your case.

What is an example of a reaffirmation agreement?

John files for Chapter 7 bankruptcy. He owns a car that is worth $10,000 but he still owes $12,000 on the car loan. If John wants to keep the car, he may want to consider reaffirming the debt. Under this scenario, John will enter into a reaffirmation agreement with the lender and will continue to make his monthly car payments until the car loan is paid off. John will remain personally liable for the loan even if his other debts are discharged under his Chapter 7. This means that if John does not make the car payments under the reaffirmation agreement, the lender may take action against him, such as repossessing the vehicle.

Conclusion

Deciding whether to enter a reaffirmation agreement requires weighing your desire to keep certain property with the potential risks to your financial recovery. Understanding the process and implications of what is a reaffirmation agreement in a Chapter 7 bankruptcy can empower you to make the choice that best suits your situation. Remember, while bankruptcy is designed for a fresh financial start, sometimes those first steps involve carefully deciding which financial commitments to keep and which to let go of.

If you have questions about reaffirmation agreements or any questions regarding bankruptcy, you can can contact our law office at (888) 584-9614.